We’ve all seen the headlines: AI leaves systems integrators behind! Services as Software comes for consultants’ jobs!

There is no doubt that AI is fundamentally altering the tech services landscape, however, we do not believe that AI will be the extinction event for services that so many predict.

For decades services firms have had to reinvent to stay ahead of their clients. It happened when mainframes shifted to PCs, when the Internet took hold, and across all three waves of cloud computing.

The partners at Tercera have built and invested across a number of different eras, and in every one of them, we’ve seen companies adapt and reinvent. I think back on Microsoft and Oracle’s struggles in the early days of the cloud, and how so many (including me) dismissed them as dinosaurs who would never be able to quit their cash cow businesses. Today, these two companies are leading in the AI era, and their market caps show it.

That said, for every one company that adapted, five didn’t. Just look at Peoplesoft and Siebel in software. Or EDS as the cautionary tale of a services firm that completely missed the move to cloud and new sourcing models.

New eras reset the scoreboard, and the tech services game is about to get heated.

It’s why we developed The New Services Playbook for the AI Era – a research-based, practical guide to how services are evolving and what to do about it. The playbook includes data and insights gleaned from a survey of 300+ services leaders, along with interviews with enterprise buyers, software vendors, traditional services leaders and founders building in the AI era.

The Rise of AI-Native Firms and Services-as-Software

It’s clear that AI is putting pressure on services businesses, and in the next five years, we believe growth for traditional labor-based services will slow or even decline while the market learns what AI can and can’t do. However, AI in the long run should lead to more service opportunities, not less.

Every process, business decision and tech investment will need to be rethought through an AI lens. AI will solve one set of problems faster and more cost effectively than before, but it will exacerbate and create entirely new challenges that will need to be resolved.

Who solves those problems, and how those services are delivered, is changing though.

AI-native firms – companies built from the ground up, or completely rewired, to put AI at the center of their operations and offerings – are changing the narrative. AI-native firms don’t just use AI, they’re rethinking entire value chains through the lens of AI so they can move faster, deliver at dramatically reduced costs, and tackle problems that were once out of reach. It’s these AI-native firms, not AI, that are the existential threat for legacy service providers, and they are coming for their customers, employees, partners and investors.

It’s these AI-native firms, not AI, that are the existential threat for legacy service providers, and they are coming for their customers, employees, partners and investors.

Many AI-natives are building their offerings in a new Services-as-Software model – an AI service layer that automates traditional services, and delivers them through a repeatable, software-like experience and subscription model. Analyst firm HFS, which initially dubbed the term, believes this could be a $1.5 trillion in the next 10 years, and expects this new category to take share from both software and traditional services. This won’t be too dissimilar from what happened with on-premise software when SaaS and cloud computing took hold.

Why are AI-Natives Winning?

AI-native firms are getting attention from customers and investors for a number of reasons:

Accelerated Delivery, Higher Margins

AI-native firms can deliver results far faster, at higher margins by automating tasks that once required large teams and manual processes. Similar to the cloud shift, we believe speed and cost will be early drivers of AI adoption and will put near-term pressure on what firms can charge for their services. However, innovation is the real game changer and clients will pay for that.

Ability to Charge Based on Output, Not Input

AI lets services firms shift from charging for inputs (hours, headcount) to charging for outputs (results, adoption, performance). As low-value busy work gets automated, a partner can spend more time delivering value further up the stack. Charging for value delivered, not how long or how many people it took to solve a problem, has been the holy grail for services firms. However, the use of AI is now forcing it.

Talent Leverage

Rather than scaling through armies of junior consultants, AI-native firms can use AI and agents to handle repeatable tasks. Junior talent will still be needed, but there may be fewer roles. Senior talent can focus less on recruiting and on-boarding, and more on solving client problems and discovering new revenue streams. In theory, these firms are more resilient to attrition and bring in much higher revenue per employee, up to 30-40% higher in some cases.

Market differentiation

With AI central to their brand, offerings and culture, AI-native firms are getting attention from large customers who recognize that navigating the AI era may require a different type of services partner. Customers who are fed up with wasting millions on failed, multi-million dollar, multi-year transformation efforts and want partners who look and operate differently.

Traditional Services Firms Fight Back

All this said, tech services leaders see what’s coming. They aren’t sitting on the sidelines.

This summer we surveyed more than 300+ tech services leaders to understand how they were incorporating AI into their operations and future strategies. Nearly 100% of the respondents said their firm was using AI – 85% said AI was a top 3 priority, and nearly 30% said it was their number one priority.

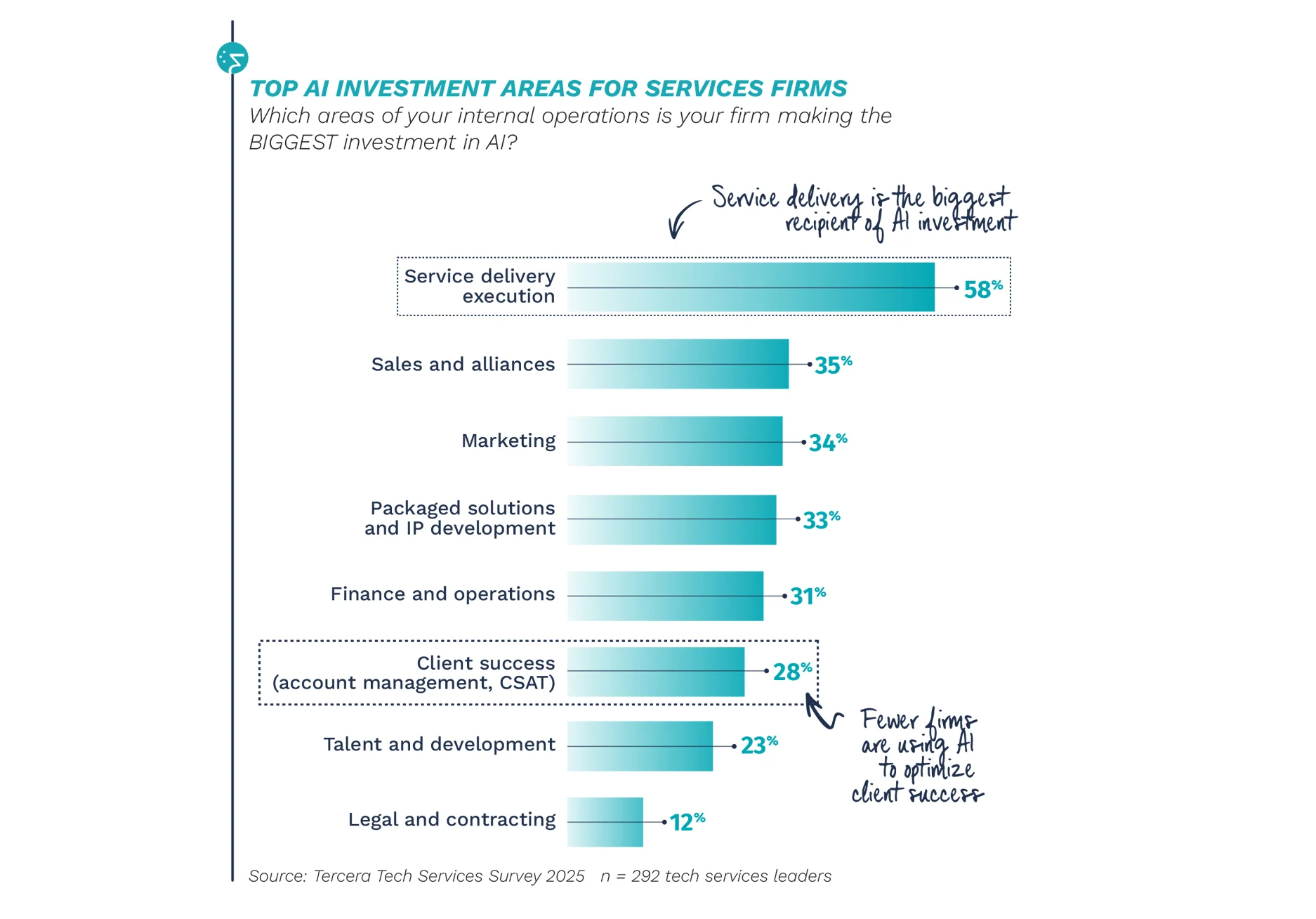

The biggest area of investment for services firms today is in service delivery execution. This is an area where the AI-native firms are leaning in hard to automate, and traditional firms know this is their revenue engine.

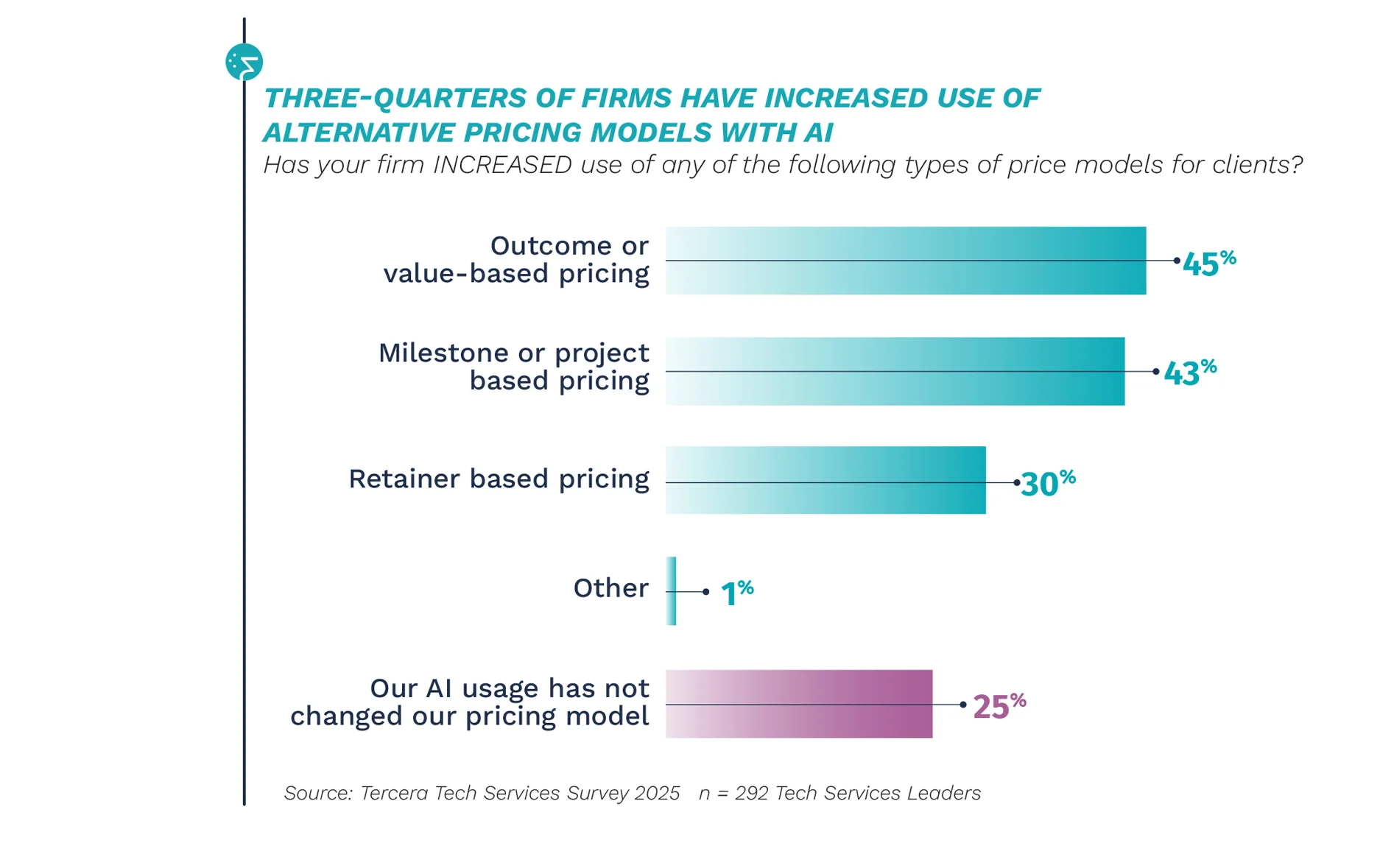

The majority of respondents were also increasing their use of alternative pricing models, with 45% of respondents already experimenting with outcome or value-based pricing.

Existing firms aren’t sitting still. They also possess several hard-won, wide-moat strengths that they can capitalize on to compete with AI-native entrants. One strength is their deep experience with complex enterprise environments. Newer entrants are bound to underestimate the messiness of large organizations and the complex realities of integration and legacy systems.

Existing firms aren’t sitting still, and they possess several hard-won, wide-moat strengths that they can capitalize on to compete with AI-native entrants.

Additionally, strong customer relationships and trust, built over years of delivering services, remain a major advantage. Clients are people, and people look for trusted partners who have been in the trenches with them, who can provide cover when things get tough, and act as a “throat to choke” if outcomes fall short. While many legacy firms are still coming up to speed on AI, these firms deeply understand issues like data privacy, governance and regulations, security and change management. All of which are hugely important in the AI era.

Traditional firms that can combine their existing expertise, relationships and human judgement with the speed and capabilities of AI and agents, may find they have a leg up on AI-native firms. Especially if those new, tech-focused firms ignore the first principles of consulting in their rush to automate.

The Game Changes, But We’re in Early Innings

We’re still early in the game. Many companies are building products to automate parts of the service delivery lifecycle, but true AI-native firms that can navigate complex enterprise environments and deliver fully trusted solutions using AI agents still remain relatively rare. For now.

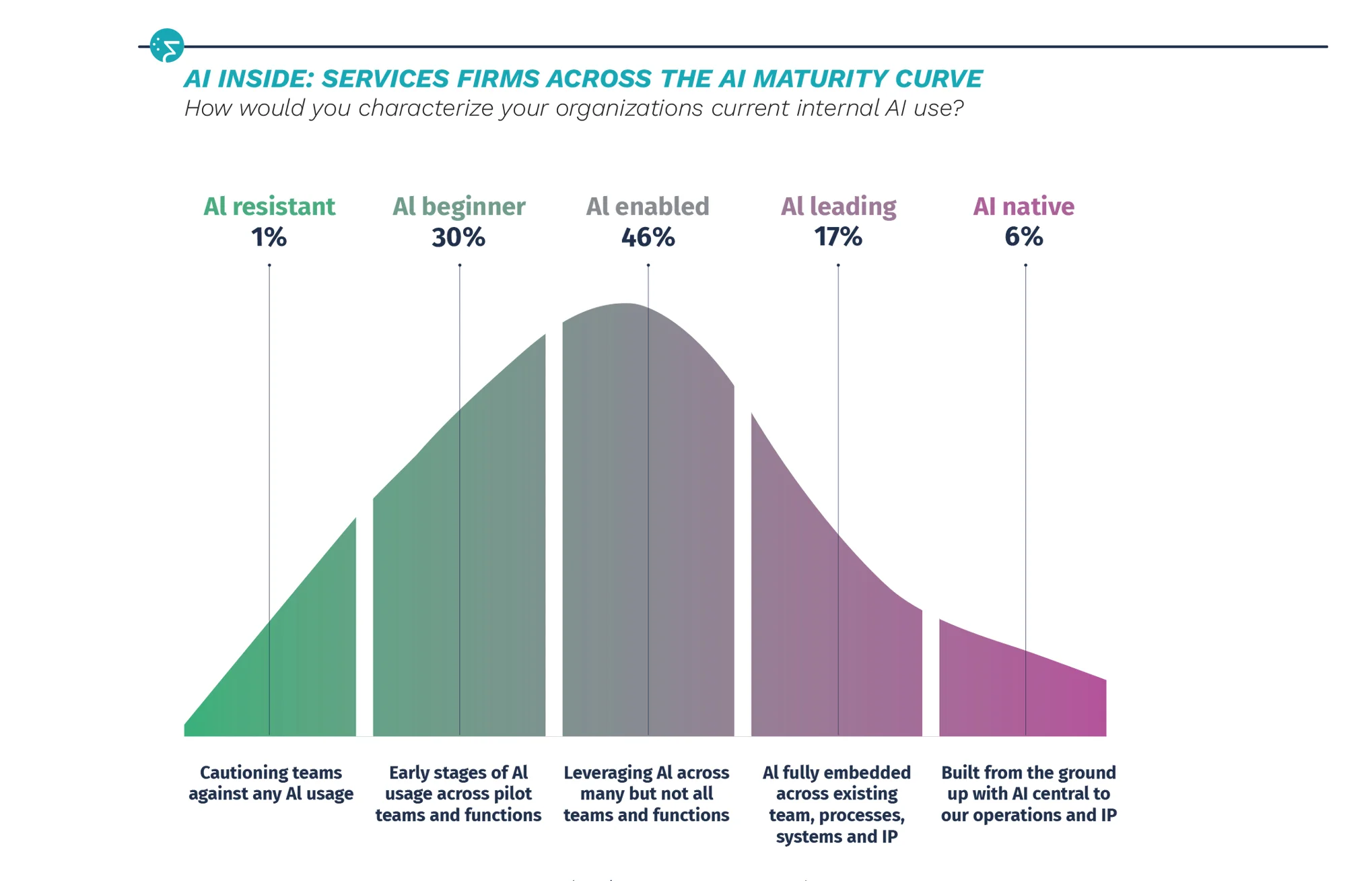

Today, only 6% our survey respondents said they would characterize themselves as an AI-native firm. Six months from now, we expect that number to increase dramatically, especially with the amount of capital flowing into this space. Every day we hear from engineers from tech titans or senior leaders from brand name consulting firms leaving to form AI-native firms, with the goal of chipping away at the trillion-dollar IT services industry.

But it takes time for true market transformations. If you want inspiration for how this could play out, take a look at the electric vehicle (EV) market. The first mass-marketed EV from GM was launched in 1996. Nearly 30 years later, the EV market is booming but it’s still only a quarter of the market. Not everyone is ready for an EV yet – the infrastructure is still evolving in some markets, the technology is still advancing, and behavior change takes time.

It’s why hybrid vehicles are so popular. They combine the familiarity and convenience of gasoline with the next-generation benefits of renewable power. Hybrid service models may see a similar path, combining the advantages of established ways of working and new technologies.

However, AI is evolving faster than anything we’ve seen in the past. If these AI-native firms and leaders can deliver on their promises, and can scale fast without needing to find, hire and onboard thousands of consultants every year, they’ll take share fast – from both traditional software and traditional services firms.

How To Stay on the Winning Side

The best way services firms can stay on the winning side is to know that the game is changing, and that the playbooks that worked five years ago won’t apply in the next five. It’s why we wrote the New Services Playbook for the AI Era.

Here are a few pieces of advice pulled from the playbook to help you navigate this new world we’re in. Because it’s not the first time services firms have had to reinvent themselves, and it won’t be the last.

1. Know thyself

Reconfirm your firm’s value and identity, and define how that can evolve to redefine your competitive moat.

2. Move up the stack

If your value proposition is becoming commoditized, determine how AI can enable you to transition to a differentiated, higher value service.

3. Double down on outcomes and client service

Capitalize on your competitive advantages – experience and expertise – and on delivering the value that your clients seek.

4. Be client zero

To be an AI consultant, your team and leadership, especially the CEO, must be power users. Avoid the risk of falling back on legacy ways of working while the market surges ahead.

5. Tap into collective intelligence

Deploy your firm’s collective expertise inside to redefine partner relationships and how you co-create with them and customers. Consider the potential of agent-to-agent collaboration.

6. Remember it’s still a people business

Double-down on your relationships. Both your employees and your most important customers as you navigate this transition. For centuries, people have been hiring, buying from and working with people. That isn’t going to change. At least not anytime soon.