As we do every year, we started out 2025 with a set of predictions for the tech services market for the 12 months ahead. Now, with the end of the year just a few weeks away, it’s time to review just how right (or wrong) we were.

We’re proud to say this year’s forecasts were our most accurate to date. With more predictions than usual (10 in total) we scored almost all As and Bs with two Cs in the mix. Not bad, but it’s a sign to push ourselves to be bolder next year. And maybe do fewer predictions.

Here’s a closer look at the 10 IT services trends we said would shape the year, what we thought would happen, and what actually did.

Prediction 1: Pockets of growth return

Grade: A-

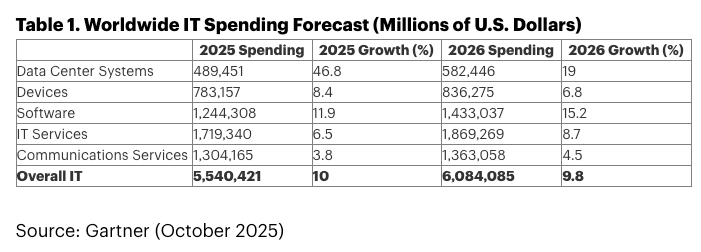

The services sector did see growth in 2025, but not uniformly. According to Gartner, year-over-year (YoY) growth in worldwide IT services spending remained well below the highs of 2021 and 2022, and is expected to land around 6.5% YoY for 2025. Certain segments such as data and AI grew faster, while other segments like commerce and digital engineering services saw greater headwinds.

The software sector in general performed well. The median growth rate of all the publicly traded software companies we track in the Tercera 30 was around 17%. Of course some companies performed better than others. The hyperscalers (Microsoft, AWS, Google, Oracle) reaccelerated, while data players like Snowflake, Databricks, MongoDB, Rubrik outperformed as well. The foundational AI platforms (Anthropic and OpenAI) saw jaw dropping growth, while continuing to raise capital to advance their models, build out offerings and invest more deeply in infrastructure and their partner ecosystems. All of which provided opportunities for services firms who have figured out how to play here.

We predicted tailwinds in industries such as insurance and healthcare. According to Gartner, IT service spending in insurance in 2025 is projected to come in at 8.1% YoY growth in 2025, exceeding broader IT service spending estimates. We’re seeing many AI native software and services firms leaning into this vertical, putting pressure on incumbent vendors like Guidewire and Sapiens, although Guidewire is showing some acceleration as of late.

IT service spending in Healthcare and Life Sciences is projected to grow closer to 6% YoY. The healthcare sector in the U.S. saw more headwinds than expected, with tariffs impacting the supply of medical equipment and pharmaceuticals, along with policy changes and funding reductions to programs like Medicaid.

Prediction 2: Game time for GenAI: production projects double

Grade: B

We were directionally right that 2025 would be a breakout year for GenAI moving beyond pilot mode. However, the picture was more nuanced than a clean 2x conversion rate. Production deployments expanded meaningfully, yet the actual rate of pilot-to-production success remains hard to pin down and, in some cases, hotly debated.

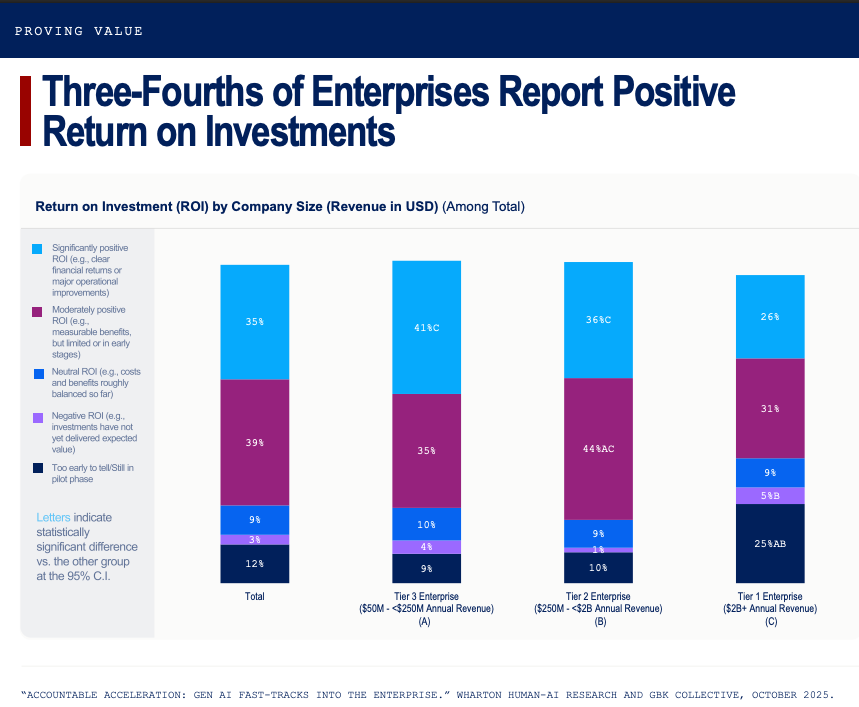

A widely referenced MIT study suggests that only around 5% of GenAI projects were considered successful, while a McKinsey 2025 state of AI survey found 88% of companies are now using AI in at least one function. A recent study from Wharton and GBK Collective added more optimism to the mix, finding that three-fourths of enterprises report positive ROI on their GenAI investments. Most of the respondents in the Wharton study (88%) say they’ll increase spending in the next 12 months, which is perhaps the biggest sign that companies are beginning to see results.

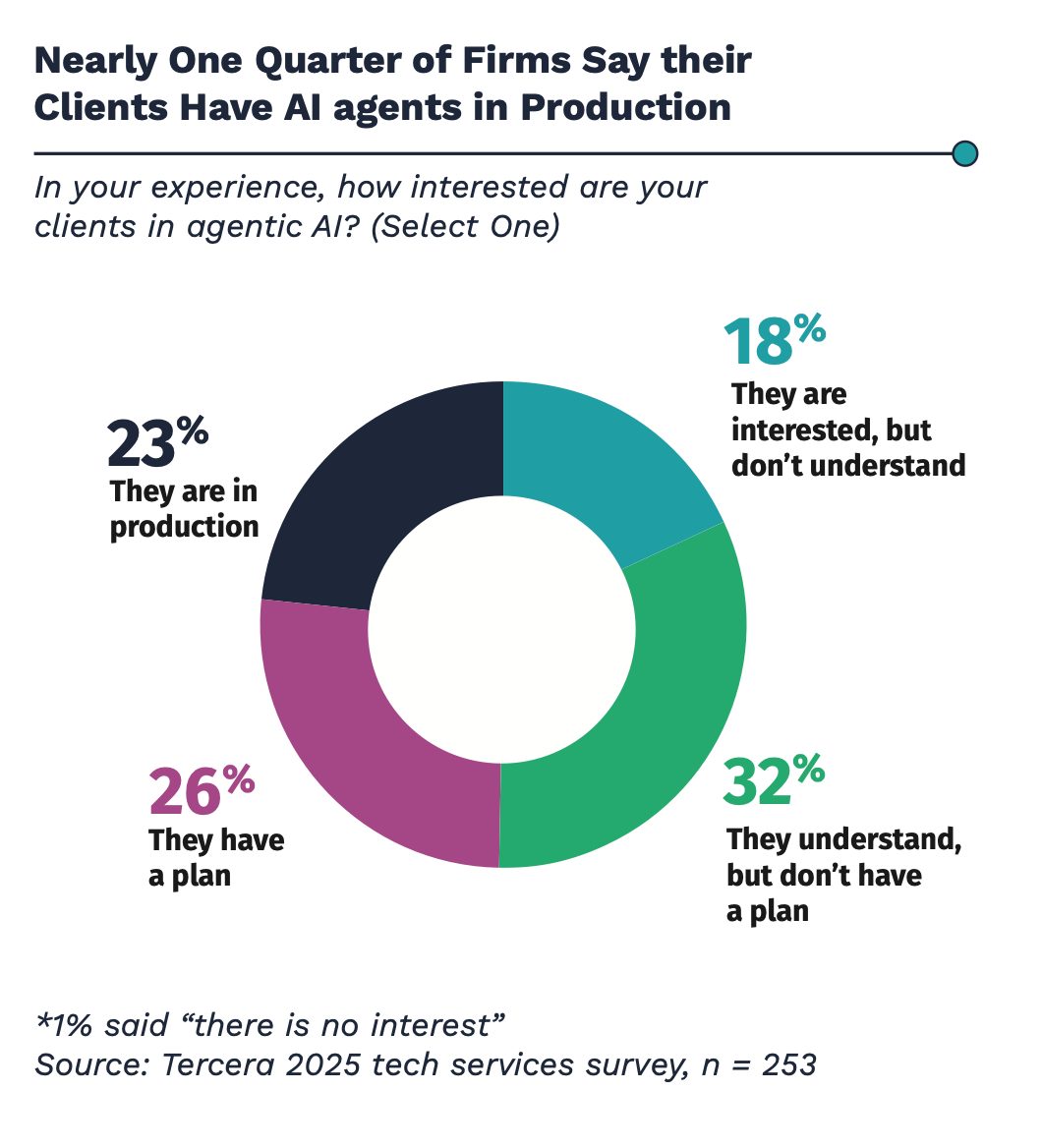

In 2025, the AI narrative pivoted rapidly to agents. Every software vendor in our 2025 Tercera 30 has announced investment or offerings here, and it’s on the agenda for their customers and partners as well. A Tercera survey of 320+ services leaders this summer indicates that more than a quarter of IT services firms now have clients with AI agents in production.

Prediction 3: AI-native consultancies challenge public firms

Grade: A

This one proved spot on. AI-native consultancies are starting to materially challenge larger public firms, not just on cost and speed, but increasingly on specialization and IP-led delivery.

Press coverage throughout the year spotlighted emerging AI boutiques winning deals from the likes of McKinsey, Bain and the Big Four. AI-native players aren’t just putting pressure on the GSIs, but targeting the mid-market as well. Along with the boutique firms that have specialized there.

What we didn’t anticipate was how quickly the big consultancies would counter, leaning hard into a build–buy–partner playbook to keep pace. All of the GSIs are pushing hard to retool and build for the AI era.

Some did this through M&A. For example, IBM this year acquired Hakkoda and Datastax, buying AI capability to complement their existing organic efforts.

Many are leaning into build mode. Genpact’s Chief Agentic AI Officer, Jinsook Han, spoke at Tercera’s annual Leadership Retreat about the company’s GenpactNext strategy and how its Advanced Tech Solutions group are putting verticalized AI agents to work.

Others are leaning more into partnering. For example, we’re seeing both large and boutique consulting firms choosing to partner with AI-native Services-as-Software platforms like Auctor AI and Bridgetown Research to accelerate workflow and expand capabilities.

Whether the strategy is to build, buy or partner (or increasingly a combination of all three), it’s clear that AI is forcing firms of every size to adapt.

Prediction 4: Focus shifts from hours to outcomes

Grade: C+

We were a bit too optimistic here. While firms did make progress experimenting with outcome-based pricing models, most customers and firms remain firmly attached to the by hour, time-and-materials model. Procurement teams for the most part still default to traditional structures, and sales and delivery teams are still learning how to scope, deliver and measure true outcome-based work.

Many providers are experimenting with new pricing models, finding different ways to capture value from their AI investments and adapt to competitive pressure in the sales cycle. Experiments range from billing for agents or ‘digital FTEs’ based on the value they deliver, to carving out pieces of a project that can be delivered as a fixed fee with a bonus if certain metrics are hit, to true outcome-based engagements.

There are signs the larger firms are making progress here. McKinsey claims that a quarter of its global fees are now outcome based, and Globant’s subscription-based, tokenized AI pods that move from hourly billing to AI-metered usage.

As early experiments play out, and AI moves deeper into production and operations, pricing models will shift. However, it’s going to take longer than many of the headlines suggest.

Prediction 5: The HAIDaMo mafia tightens its grip

Grade: A+

This year the hyperscalers, AI providers, and data modernization (HAIDaMo) players reinforced their position at the center of the modern enterprise IT stack.

Of the publicly traded companies we track in the Tercera 30, the players in this category generated 78% of the total revenue growth. This excludes high-flying private companies like OpenAI, Anthropic and Databricks, but it does include Nvidia which continues to grow at an unprecedented rate.

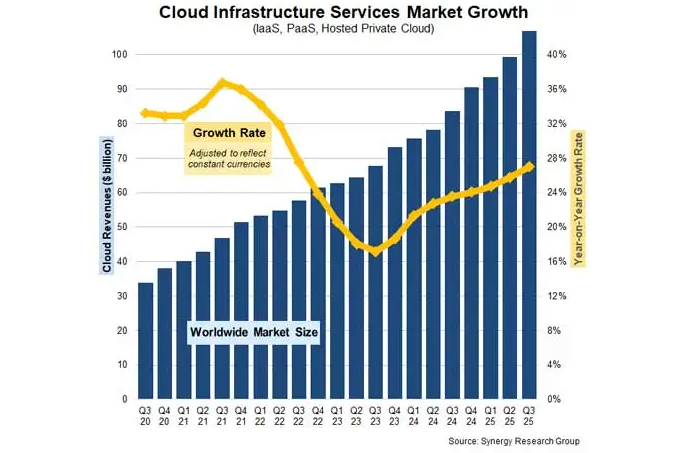

The big 3 hyperscalers (AWS, Microsoft Azure, Google Cloud) continued to consolidate wallet share, now holding 62% of the cloud market. In Q3, AWS revenue grew 20%+, and is now at a $132 billion annual run rate (yes, billion). Microsoft’s Intelligent Cloud group, which houses Azure, grew 28%+ at an annual run rate of $123 billion. Google’s cloud group grew 34% in Q3 with an annual run rate of nearly $61 billion, while its newest Gemini release is setting new benchmarks for the competition.

It’s not just the hyperscalers. IBM doubled down on AI, hybrid cloud, and quantum computing, and its recently announced Confluent acquisition is poised to further strengthen its capabilities here. Oracle reasserted itself, signaling to investors that it expects its cloud business to grow more than 40% in its next fiscal year while deepening co-sell arrangements that make its database accessible across all major clouds.

Snowflake and Databricks posted strong performance for the year providing tailwinds to partners, while the big names in AI (namely Anthropic, OpenAI and Palantir) remained gravitational forces.

All this level of momentum, and the unprecedented capital still pouring into this space, means these ecosystems are only getting more and more competitive. Partner programs here are tightening, expectations for technical depth are rising, and the barrier to meaningful differentiation is getting higher.

Prediction 6: Partners trade monogamy for polyamory

Grade: A

As expected, in 2025 services firms continued to expand beyond single-ecosystem strategies, with diversification becoming the norm rather than the exception. Relying on one ISV to scale to $50 million is increasingly rare for an IT services firm, and most now recognize the need to work across multiple ecosystems to fully address client needs. This is especially true with AI and agentic processes which often span different systems.

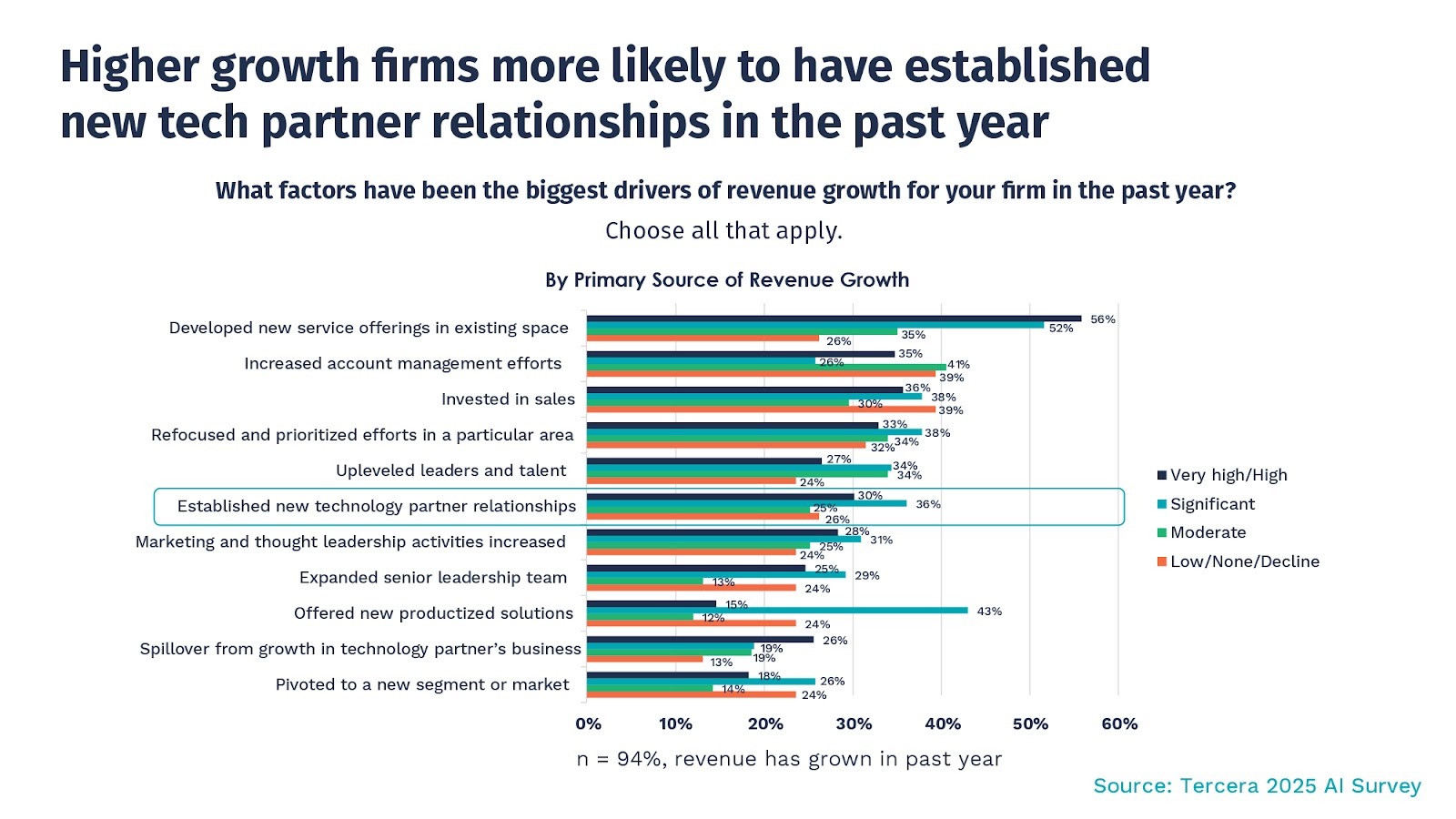

Tercera survey data backs this up. In a 2024 survey of IT service leaders, firms reported maintaining 3-6 partner relationships, with larger firms naturally carrying wider portfolios. In our 2025 survey, 70% said they had grown their partnerships over the past 12 months — 55% slightly and 15% significantly. High-growth firms pushed even harder: 82% expanded their partner ecosystems, and they were over two times more likely to grow partnerships “significantly.”

We also saw firms deliberately branching into adjacent partner ecosystems, and beginning to experiment with an expanding universe of AI and agentic partners. This is a space that’s both full of opportunity and notoriously difficult to navigate. The shift toward an “ecosystem of ecosystems” is no longer a conceptual ideal, it’s becoming table stakes.

Prediction 7: The return of on-prem priorities

Grade: B

With enterprise buyers prioritizing AI strategies and holding off on large transformational projects, we expected a slight downtick in cloud migrations and an uptick in on-premise and data center investments.

Investment in these areas did surge. According to the Gartner report mentioned above, spending on data center systems is expected to grow a whopping 46.8% this year. Much of that is driven by the AI juggernauts. However, enterprises are also investing here as they lean into their own AI capabilities, and manage more data-intensive applications that have certain bandwidth and latency requirements and bring compliance complexities.

Yet, cloud migrations marched on. More than 90% of enterprises now have some workloads in the public cloud, and as the growth of the hyperscalers suggest, that will only increase.

What really defined 2025 is hybrid computing – not a pure on-prem return. There is a growing desire among enterprises to mix infrastructure types based on specific use cases and to increase flexibility and resiliency.

What really defined 2025 is hybrid computing – not a pure on-prem return. There is a growing desire among enterprises to mix infrastructure types based on specific use cases and to increase flexibility and resiliency. All of this benefits vendors and partners with the capabilities to work across diverse, complex enterprise architectures.

Prediction 8: Employers retain control

Grade: A

Employers (mostly) stayed lean through 2025, prioritizing AI investments, employee productivity and increasing margins over pure growth. This has kept a firm grip on wages, and meant power remains in the employer’s court.

According to the National Center for the Middle Market, business services firms grew employment 8.3% YoY (as of July 2025), several points below recent years. Layoffs across tech continued in smaller, serial waves: Challenger reported 71,321 planned cuts in November 2025 and 1.17 million year-to-date, the highest since 2020. Hiring plans sank to their lowest level since 2010. All of which reinforce employers’ leverage.

However, within the AI sphere, the market played by a different set of talent compensation rules. AI engineers, ML specialists, and other top talent commanded outsized pay. Well-funded players battled for scarce expertise. While for most roles, employers held the upper hand, for elite AI talent, employees could name their price.

Return-to-office mandates strengthened as we predicted, especially in fast-moving AI environments where in-person collaboration and a “9-9-6” pace (9 am to 9 pm, six days a week) became the norm and even a badge of honor.

Prediction 9: Africa on the rise

Grade: C

We were directionally right on this one, but other regions saw greater investment this year and large scale tech services investment in Africa is unfolding slowly.

Africa continues to gain traction as a source for talent, especially in Kenya and South Africa. Many African countries are seeing positive signs of investment. For example, Kenya’s investment authority projects the country’s Global Business Services sector will reach $700 million by 2025 and climb toward $1 billion by 2030. South Africa is also strengthening its position, with its GBS workforce more than doubling since 2019, and revenues nearly tripling through 2024.

Talent supply continued to expand as well. Andela, the Linux Foundation Education, and the Cloud Native Computing Foundation (CNCF) collaborated to launch the Kubernetes African Developer Training Program in 2025 to train tens of thousands of African technologists in cloud and AI-adjacent skills. Vendors like ServiceNow are also investing in training and supporting partners in the region. All of this is part of a broader wave of AI-native talent entering the workforce thanks to the continent’s relatively young population.

Still, constraints remain. Complex engineering is still maturing in the region. While the pool of junior talent is large, there are fewer mid-level and senior specialists available than in some other regions. And while cost advantages exist, they’re not as dramatic as some buyers might anticipate.

In contrast, other regions like India, are seeing greater investments by big tech players. Amazon recently said it would invest $35 billion into India between now and 2030, and Microsoft said recently they are committing more than $17 billion to the region.

India is seeing greater investments by big tech players. Amazon recently said it would invest $35 billion into India between now and 2030, and Microsoft said recently they are committing more than $17 billion to the region.

Africa is still well positioned to be a talent destination for software and services firms in the future. However, 2025 was just not the breakout year we predicted.

Prediction 10: All eyes on the Trump Administration

Grade: A

Retrospectively, this one was too much of a layup. Of course all eyes are going to be on the Trump Administration. No matter what side of the aisle you are one, this Administration is hard to pull your eyes away from.

Here’s what we know. As expected, the Administration did freeze spending, cut programs and implement tariffs. However, it happened far faster (and far more unpredictably) than we expected. Our view was that the government is vast and complex, and change would take time. But less than a year into the Administration, the federal government has already undergone significant change, with certainly more to come.

Another part of our prediction was that federal spending would remain lucrative for software and services companies as the administration invested in automation and commercial software to create efficiencies. That one held true, with defense, cybersecurity and AI acting as counterweights to softness in certain civilian agencies.

The Federal IT Dashboard shows $102.3 billion in requested FY2025 IT spending — a 10.8% increase over the $92 billion request in FY2024. Historically, actual spending exceeds requests, so the final tally is likely to be even higher.

Those servicing the defense sector saw spending increase, with Palantir emerging as a clear winner, reporting 52% YOY growth in U.S. government revenue in Q3. Vendors like Salesforce and ServiceNow leaned in hard with efficiency messaging, and price cuts to stay entrenched. Yet some vendors saw a target on their back.

The administration’s moves around tariffs, immigration, and its unfortunate crusade against DEI had significant impacts well beyond just spending. Retailers and construction have had to rethink supply chains and absorb costs related to tariffs; education and healthcare institutions that are heavily dependent on government grants have had to reconsider investments; and services firms are keeping a very careful eye on the HIRE Act which could impose new taxes on offshore payments.

Not quite honor-roll status, but comfortably above average

Our forecasts were more on the mark than previous years and that’s saying something considering the pace of change. With just a solid 3.4 GPA, we’re definitely on the merit roll.

Stay tuned for our thoughts on what services leaders and investors should pay attention to in 2026. If you’d like to be among the first to review our prognostications, subscribe to our monthly newsletter or weigh-in with your own predictions by hitting us on LinkedIn.