There’s a first time for everything in business. And as a founder, that includes seeking funding.

Taking an investment isn’t something to be taken lightly. It’s a time consuming and intense process, but when done right – with the right mindset, partners and preparation – it can be a game changer. Not just for the capital it brings into the business, but also for what it can teach you about yourself, your business, your strengths and blindspots.

In fact, that combination of entrepreneurial strengths and blindspots is exactly why so many founders come into the investment process unprepared or with the totally wrong mindset. Trust us, the last thing you want to do is turn something that can be a huge advantage into a dizzying distraction… often at a pivotal time for a business.

All of this is exactly why we’re writing this blog series.

Our goal is to help first-time founders (or those who have never been through an investment cycle) better understand how the process works and how to prepare for this major milestone.

In this introductory blog, we’ll cover how you know it’s the right time to take funding, what a typical process usually looks like, and why these steps even exist. We promise you, there’s a reason for all of it.

The rest of the blog series will cover four ways to get ahead of the game and prepare for a more enjoyable (or at least less painful) process. These are:

- Getting your financial house in order

- Crafting a clear, compelling, differentiated story

- Understanding where to best invest funding proceeds

- Finding the right advisors to guide you through the process

Timing is everything…especially for services firms

Founders typically turn to investment capital for one of two reasons. They’re either growing fast, or not growing fast enough.

If you fall into the first category, congratulations! Those outside looking into this scenario might ask the natural question – why do you even need growth capital if you’re already growing? Why give up equity in the company if you don’t have to?

Yet founders in this lucky position know growth comes with its own set of challenges. Challenges like:

- You can’t hire fast enough, and cash flow starts to become an issue (building a bench is expensive)

- You’re choking the company’s growth because you can’t scale — from delaying critical leadership hires to holding off on important investments because cash is tight

- You need new practice areas or regions to meet demand and continue taking share

- Your business is outpacing your ability to see around corners

Those who aren’t growing as fast as they’d like have a different set of challenges. Isn’t business fun?! This group sees investment as a way to:

- Shift and build capabilities in higher growth ecosystems and market segments

- Recruit and retain talent to innovate and capture growth

- Invest in new products or offerings to attract and grow customers

- Fund M&A to get into new markets or fill gaps in the business

If any (or many) of these challenges hit home, it’s probably a good time to think about taking on capital. Because growth is everything, especially in technology and IT services where standing still is like taking massive steps backward.

Because growth is everything, especially in technology and IT services where standing still is like taking massive steps backward.

No one wants to join or work with a technology firm that’s not growing and evolving. As the path upward or forward gets less promising, employees and customers will leave for greener pastures.

I’m ready…where do I start?

The first place to begin is by thinking about the challenges you face. If you need the funding to expand, scale, build or compete, all of those things are about more than money. They’re about figuring out how to do it better, faster, and smarter than your competition. A partner who brings expertise — and not just a checkbook — can make a powerful difference.

A good investment process is fundamentally a search for the right partnership, where both partners gain more than either could have won on their own.

A good investment process is fundamentally a search for the right partnership, where both partners gain more than either could have won on their own.

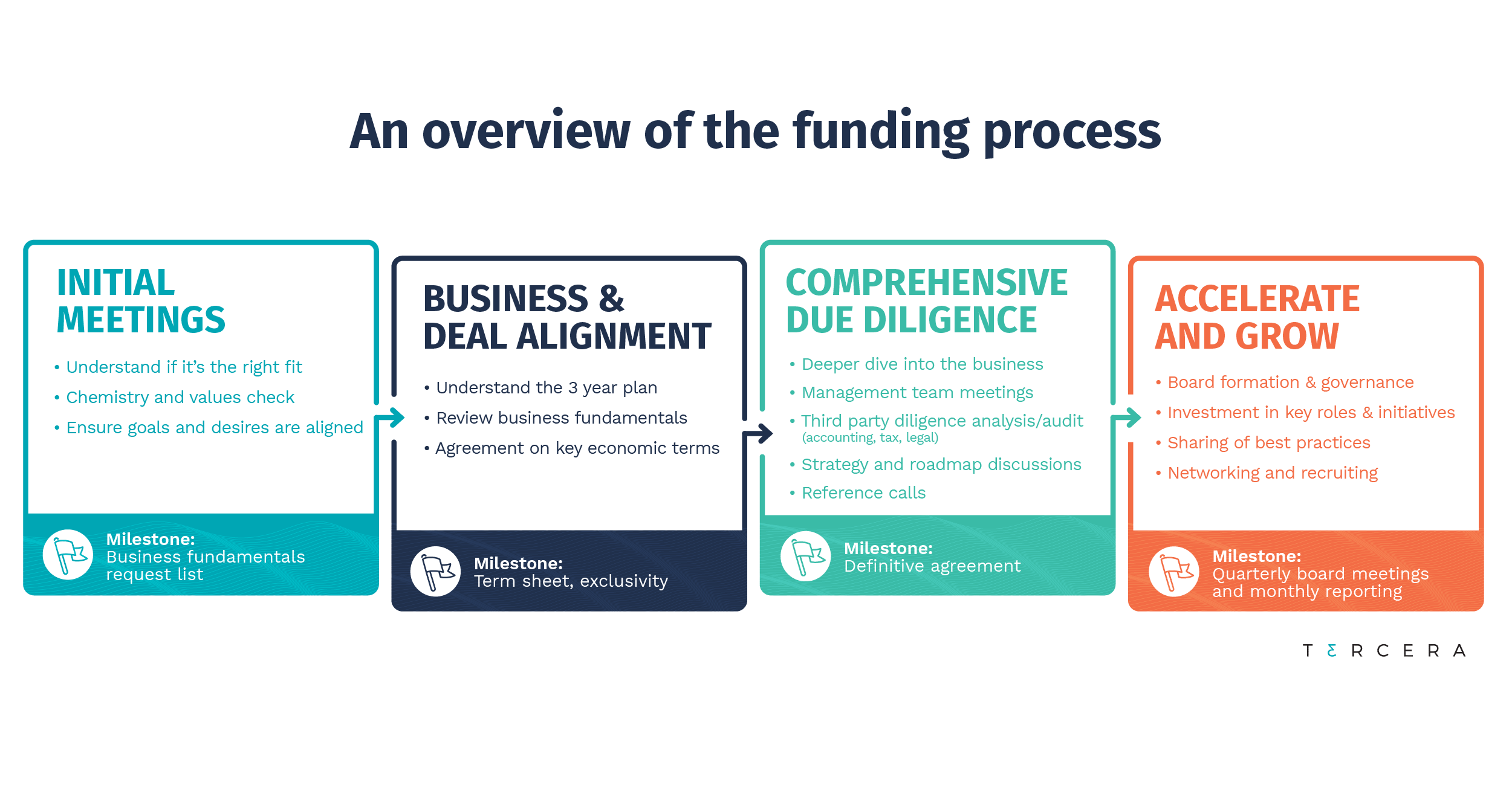

The founder-investor ‘courtship’ process tends to follow this pattern:

What’s going on behind the scenes?

While each investment firm (and type) will have their own flavor of this process, the steps are pretty consistent and build on each other for a reason.

If you fall in love with the first investment firm you meet during phase 1, don’t stop meeting with other investors. It’s worth hearing different perspectives and approaches, even if you feel you found your match on the first date.

If an investor offers to skip the deeper diligence phase and sign a deal quickly, that should be a red flag. They’re just looking to get money out the door. Good capital partners look for companies and founders where they can uniquely add value and help a company reach its highest potential. Which is why through each of these phases the investor is looking to understand not just the current business but the future value of the business as well.

IT services investors (and acquirers) will value certain business aspects more than others (we go deeper into that here). However, on the simplest level, they want to know: is it a solid, well-run business with a good vision, good customers, the right revenue mix, the right margins, and a strong team.

They’ll also be looking at how a founder manages and engages in the process, and how co-founders interact, as it’s an indication of future leadership and coachability. No one wants to get into a relationship with a narcissist, know-it-all or someone with a loose connection to the truth.

As the partner evaluates you, you should also be evaluating them. This is courtship is about more than just getting to a transaction. Through each one of these steps ask yourself:

- Is this someone I want to spend the next few years with (at least)?

- Are they just going through the motions, or are they genuinely interested in getting to know me and my team?

- Are they asking questions that make me think?

- Are their expectations reasonable?

Read the content they publish. Is it focused and relevant to your business? Is it directly useful? Is it written in plain English, or clogged with dull clichés and pointless jargon?

Ask to talk to their portfolio company CEOs. Be ready with a long list of questions.

- What value has the capital partner delivered, beyond writing checks?

- What’s the quality of their network ?

- When you need advice, how good is it?

- What value did they deliver that was beyond what you expected?

Entrepreneurship is like climbing Mount Everest. You can go it alone. But it’s a lot faster, easier, and safer to work with a team of sherpas who have climbed the mountain multiple times and know which trails are the smartest and safest, and which paths to avoid.

See you on top of the mountain.