Part 2 of the Tercera 30 survey blog series

In part 1 of our Tercera 30 survey blog series, we described how the majority of the 269 firms we surveyed for our annual Tercera 30 report are still reporting growth, despite headwinds.

In part 2, we’ll cover which partner ecosystems were the most popular, why firms are choosing to work with multiple software partners (a trend that we cover in more detail here), and how research indicates a sweet spot for the number of strategic partners a firm has.

Without further ado…

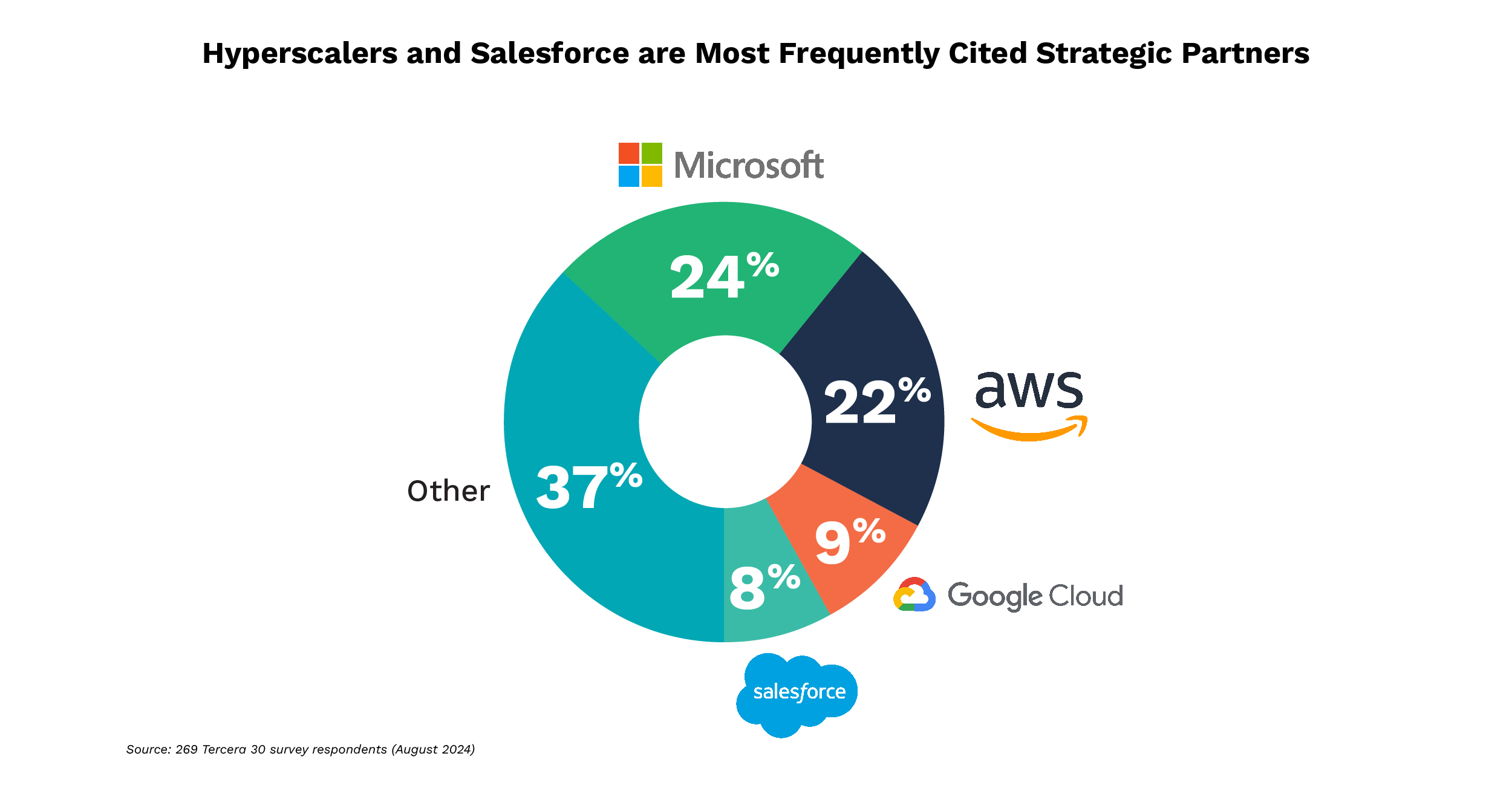

The hyperscalers and Salesforce are most frequently cited partners

More than 60% of services firms in our survey cited one of four vendors as their primary partner – Amazon Web Services, Microsoft Azure, Google Cloud and Salesforce.

It’s no surprise that the three largest cloud providers and the world’s leading CRM and customer experience company are the go-to partners for services firms. These four companies alone raked in more than $260 billion in revenue last year, and have mature, structured programs that support thousands of partners with revenue opportunities.

These large companies support partners through everything from co-marketing and events, to providing marketplaces to list offerings, to offering training and development for consultants. Some will even provide funding.

The next most frequently cited primary partners include: IBM, Adobe, Oracle, ServiceNow and BigCommerce. Overall, more than 25 primary partners were represented across survey respondents.

The next most frequently cited primary partners include: IBM, Adobe, Oracle, ServiceNow and BigCommerce.

When it comes to the most popular partner, that of course is somewhat subjective. However, the vendors selected by readers of the Tercera 30 for our 2024 People’s Choice Award were Atlassian, Databricks and Snowflake. Learn more about these awards and who came in second and third in this blog.

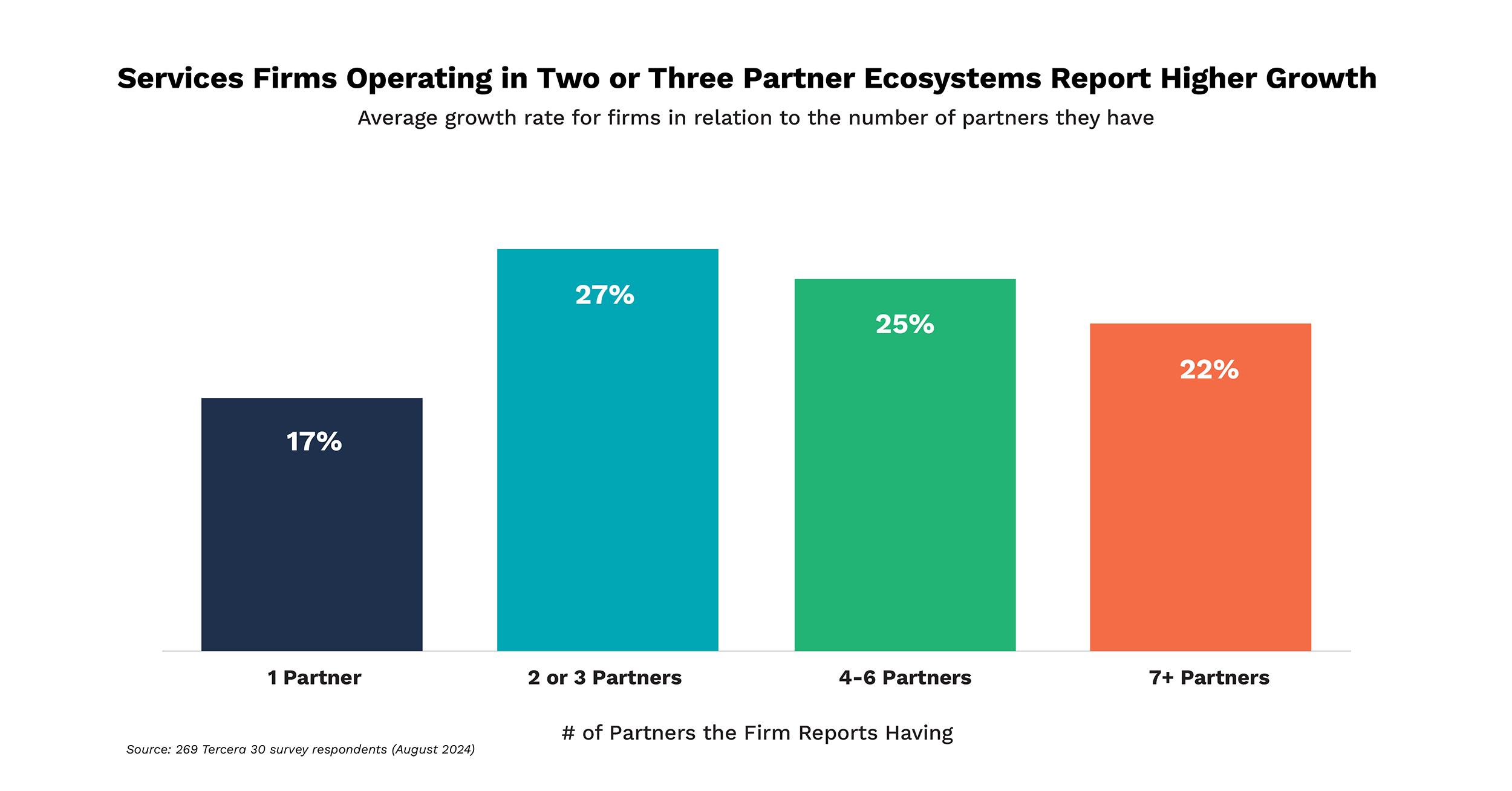

There’s a sweet spot for number of partners a firm should prioritize

While many services companies lean into one pillar partner, 83% of the technology services firms we surveyed said they had relationships with more than one software vendor, and approximately one out of five (17%) said they’re looking to enter a new software ecosystem within the next 12 months.

Services partners typically work with between three and six software firms. Not surprisingly, that number increases with company size, although not substantially.

For technology services firms of any size, having multiple partners delivers multiple benefits, such as opening the door to new ways to solve unmet client needs, diminishing risk and unlocking new growth channels. With the increasing complexity and interconnected nature of today’s enterprise tech stack, the ability to provide expertise across multiple technologies is becoming even more important.

However, services firms do need to be aware of how many is too many, and the distraction that can come from supporting too many partners. Becoming a top tier partner requires time, attention and resources. Trying to spread that love across too many partners can be challenging.

Services firms do need to be aware of how many is too many, and the distraction that can come from supporting too many partners.

In part 1 of this series, we highlighted the strong correlation between level of partnership and inbound deal flow. Top tier partners are nearly twice as likely as the lowest tier partners to say their partner brings them the majority of their deals.

However, there are real benefits to not putting all your eggs in one basket. This research piece from G2 highlights how buyers prefer to work with service providers who play across multiple software products and ecosystems.

Data from our survey also seems to prove this out. Services firms with two to three software partners reported the strongest growth, while services firms with either more or fewer partners do not grow as robustly.

If you combine the G2 data and our survey data, a sweet spot for the number of strategic partners a firm supports begins to emerge. G2’s research found a lift across satisfaction metrics for those consultants who were listed in two of G2’s ecosystem service provider categories, and found a notable dip in satisfaction among firms listed in three or more categories.

Services firms with two to three software partners reported the strongest growth, while services firms with either more or fewer partners do not grow as robustly.

It seems one partner may not be enough for customers, while too many can lead to diminishing returns and stretch firms too thin. Trying to be a master of many can result in being a master of none.

To learn more about what makes a successful software partner relationships, and the ecosystems we believe hold the greatest near term potential for services partners, take a look at our 2024 Tercera 30 report here.