How do IT services companies manage the tension between growth and profitability?

That’s the question many leaders are asking themselves, especially in these times.

Is it the right time to add extra sales reps and beef up marketing to capture share? Or is it better to focus on improving margins to conserve cash?

Should they invest in a robust learning and development (L&D) program or new delivery center to build a more diversified talent base? Or should they continue to hire experienced consultants who can be immediately deployed on projects?

Should they focus on building industry-focused intellectual property (IP) to gain a competitive edge and support future growth? Even if it means eating into profit margins?

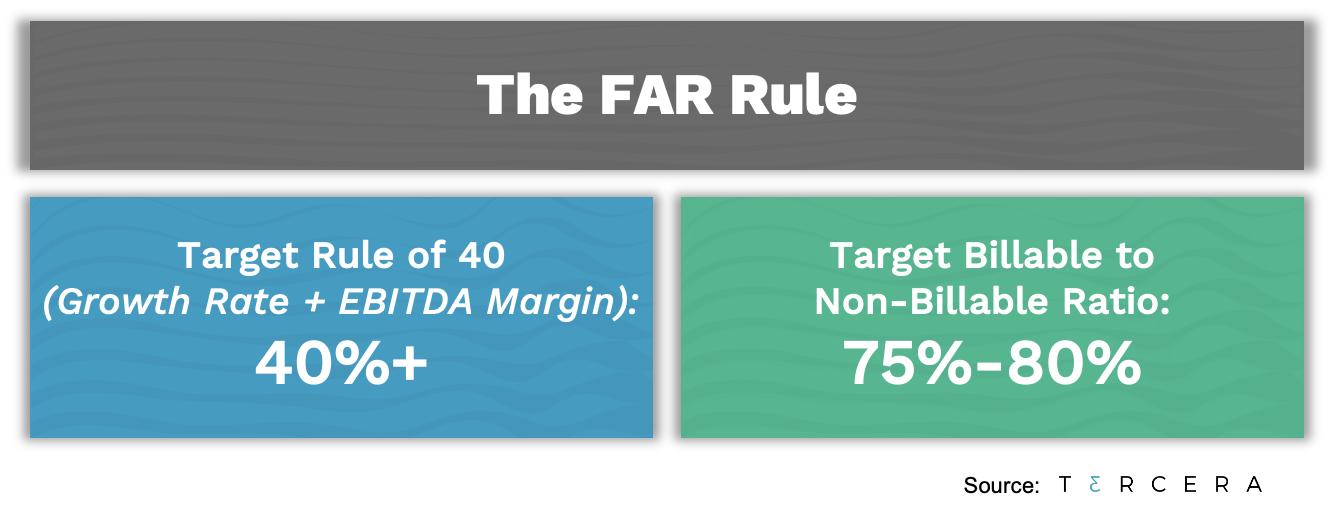

To help inform the answer to these questions, leaders should look to the Forty and Ratio (FAR) Rule. Something we at Tercera look at across our portfolio when planning for sustainable growth.

The FAR Rule pulls together two powerful metrics that many growth-focused firms already track – the Rule of 40 and the ratio of billable to non-billable headcount costs. However, it’s the combination of these metrics that is so powerful.

The FAR Rule pulls together two powerful metrics that many growth-focused firms already track – the Rule of 40 and the ratio of billable to non-billable headcount costs. However, it’s the combination of these metrics that is so powerful.

Before we dive into how you can use the FAR Rule for your own planning, let’s break down the rule’s two primary components.

The Rule of 40

The Rule of 40 is a simple metric that measures a company’s combined revenue growth-rate compared to its EBITDA margin or profitability. The sum of these two numbers should come out equal to or in excess of 40%. For example, if a company is growing at a rate of 50%, it’s acceptable to have a slightly negative EBITDA margin, up to -10%. However, if a company is only growing at 20%, it should be turning a profit of at least 20%.

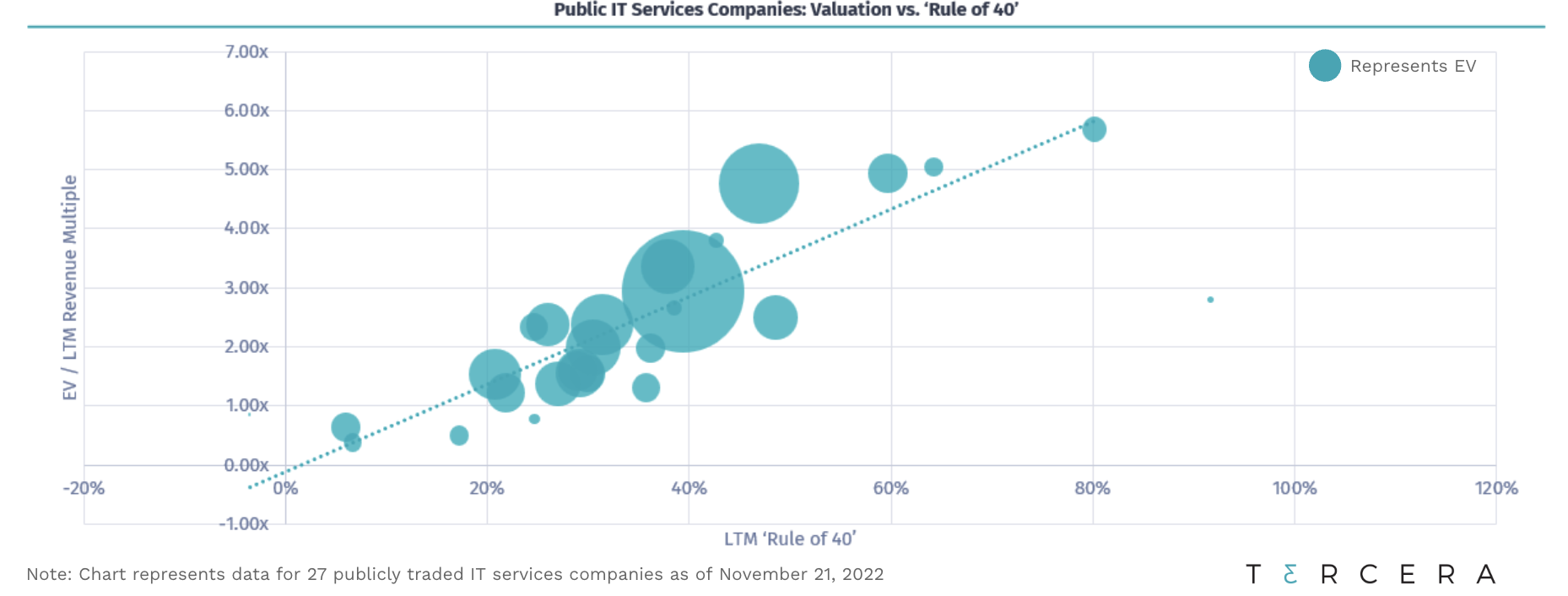

While the Rule of 40 was originally intended for venture-backed SaaS companies, it’s proven equally effective as a value indicator for IT services companies. The graph below shows how the Rule of 40 closely aligns with the valuations of public IT services firms.

This same trend holds true for the private services firms that we track as well. Those that have a Rule of 40 score above 40% are typically rewarded with a higher market valuation because they focus on the fundamentals of sustainable growth instead of growth at all costs. This is more important than ever in today’s uncertain economy.

There are certainly exceptions for every rule, and it’s important to note that the Rule of 40 can break down at the extremes. If your company is rapidly growing and running unprofitably, you need to ensure that you have the cash reserves to support it.

It’s important to note that the Rule of 40 can break down at the extremes. If your company is rapidly growing and running unprofitably, you need to ensure that you have the cash reserves to support it.

For services firms which tend to run more profitably than product companies, if profitability is slightly negative, it should be due to investing in growth activities like sales, marketing, or hiring ahead of demand. It is not an excuse to be performing low margin client work.

Billable to Non-Billable Ratio

The second metric in the FAR Rule is the ratio of billable to non-billable headcount-related costs. Put in simple terms, it’s how much of your payroll goes to people who bill clients for their time compared to how much you pay for overhead employees (sales, finance, HR, etc).

To determine this ratio simply run an employee census with the fully-loaded costs of each individual and divide it by who is billable and non-billable. Use discretion when determining billable status; for example, a pre-sales resource who only bills 5% of their time should be labeled as non-billable.

The ratio sweet spot for most IT professional services companies is somewhere between 20-25% of headcount costs being non-billable with the remaining 75-80% being billable.

The ratio sweet spot for most IT professional services companies is somewhere between 20-25% of headcount costs being non-billable with the remaining 75-80% being billable.

Again, we need to be cautious of extremes. If 90%+ of your headcount costs are billable, you likely have a very profitable business, but you could be robbing yourself of future growth by underinvesting in the foundation necessary to scale. On the other side of the coin, if you are at 60% billable, then your overhead might be too overweight. It could be time for a correction.

The FAR Rule

By themselves, neither of these benchmarking methods tells the full story of how a high-growth IT services firm is positioned for the future. A company can be doing better than the Rule of 40 for a few years, but if it’s not investing in overhead and is 90%+ billable, then it is unlikely to sustain that growth.

That’s why we find it helpful to balance the Rule of 40 with the billable to non-billable ratio, and use what Tercera calls the Forty and Ratio (FAR) Rule.

Here’s an example of the FAR Rule in action:

If your company is only 60% billable, the billable to non-billable ratio may suggest there’s a problem. However, if you’re growing at 50% and have a break-even EBITDA margin, you’ll have a Rule of 40 score of 50. Therefore, it’s acceptable not to be 75%+ billable for the time being.

However, few companies can maintain being significantly better than the Rule of 40 forever. Especially at scale. Accenture, Cognizant and the other mature consultancies struggle to achieve the Rule of 40 simply due to their size.

If you are a high-growth IT services firm, at a certain stage you will need to focus on right sizing to a 75%+ billable ratio as your Rule of 40 begins to come down. The good news is that if you’ve invested heavily in your company’s infrastructure to support scaling, most of these expenses do not need to scale in line with revenue, which means you’ll naturally move towards the 75%+ ratio as you scale revenue and delivery headcount.

If you are a high-growth IT services firm, at a certain stage you will need to focus on right sizing to a 75%+ billable ratio as your Rule of 40 begins to come down.

It’s this line of thinking that makes the FAR Rule such a useful tool for IT services companies to plan their spending and strategic initiatives in a way that optimizes for the current stage of growth, and balances it with what’s best for long term success. Combined with the guidance and support of a strategic finance and delivery function, the FAR Rule can help determine the growth necessary to warrant a given amount of spending.

On its own, the FAR Rule isn’t a magic number. However, it is a useful benchmark to ensure you’re creating a high performing company that can also have a lasting impact.