Building and scaling an IT services firm in today’s market isn’t easy. Services leaders have to keep a constant watch on everything from shifting economic conditions, to evolving talent and buyer behaviors, to the inevitable ups and downs of the platforms and partner ecosystems in which they play (or want to play).

The Tercera 30 exists to help with that last piece. To give founders and IT services leaders valuable insights into the software ecosystems that we believe hold the greatest potential for building a channel-focused technology services business.

The Tercera 30 is comprised of:

10 Market Anchors:

Large, publicly-traded software companies with mature ecosystems

10 Market Movers:

Large and mid-size public software companies with evolving ecosystems

10 Market Challengers:

High growth private software companies leaning into partners

5 Ones to Watch:

Software companies not on the list but worthy of a look for the right firm

We started the Tercera 30 in 2022, building on research that helped guide many of our own initial investments in ecosystem leaders. Since then, we’ve refined our weightings and added more qualitative research.

Over the last three years, it’s been fascinating to see the evolution of the software vendors on the Tercera 30. Which ones continue to excel and drive partner growth, which ones have matured their programs over the years, and which ones have stagnated.

In the following pages, we invite you to peruse this year’s list, along with key takeaways from our analysis.

We develop our annual Tercera 30 list through a combination of quantitative and qualitative research. We start with a list of 150 partner friendly B2B software companies. From there we evaluate them across 20 different data points that are weighted across four areas we believe make up a great partner ecosystem:

We combine the weighted scores with insights from a variety of sources, including a survey of 250 services leaders as well as a group of market advisors, investment bankers, and research analysts who specialize in IT services.

Our final step is a healthy debate and discussion within our own team of former operators and investment professionals. The resulting list combines these different perspectives into a single list.

While we feel our process is comprehensive, it’s important for leaders to consider this as one data point. Picking the right partner to build around should factor in dozens of variables. If you don’t see a name on this list that deserves consideration, or disagree with the names that are, we would love to hear from you.

There are seven new names on this year’s Tercera 30. Four new Market Movers (Braze, Dynatrace, MongoDB, Zscaler) and three new Market Challengers (Anthropic, Cohesity, Wiz).

These additions are the result of not only their individual market and partner performance, but also the growing momentum for all things AI, data management and cybersecurity.

Most of these companies are still evolving in their partner journey, and as a result, may be better to explore as adjacent or solution partners to another larger anchor partner in the near term. However, customer interest in these segments is high, which is creating momentum to services partners who can provide expertise here.

The software companies that dropped off the list this year – Crowdstrike, Datadog, Dataiku, HashiCorp, HubSpot, Outsystems and UiPath – did so mainly to make room for newer entrants.

The majority of these firms continue to do well in many ways, however, there were factors for each that gave us pause. Our objective with this report to profile the vendors we believe offer the best bet to build or expand into over the next 1-2 years, and we believe there are some headwinds in these ecosystems that put others ahead of them.

We’ll be exploring these decisions in more detail on our blog. Click here to subscribe.

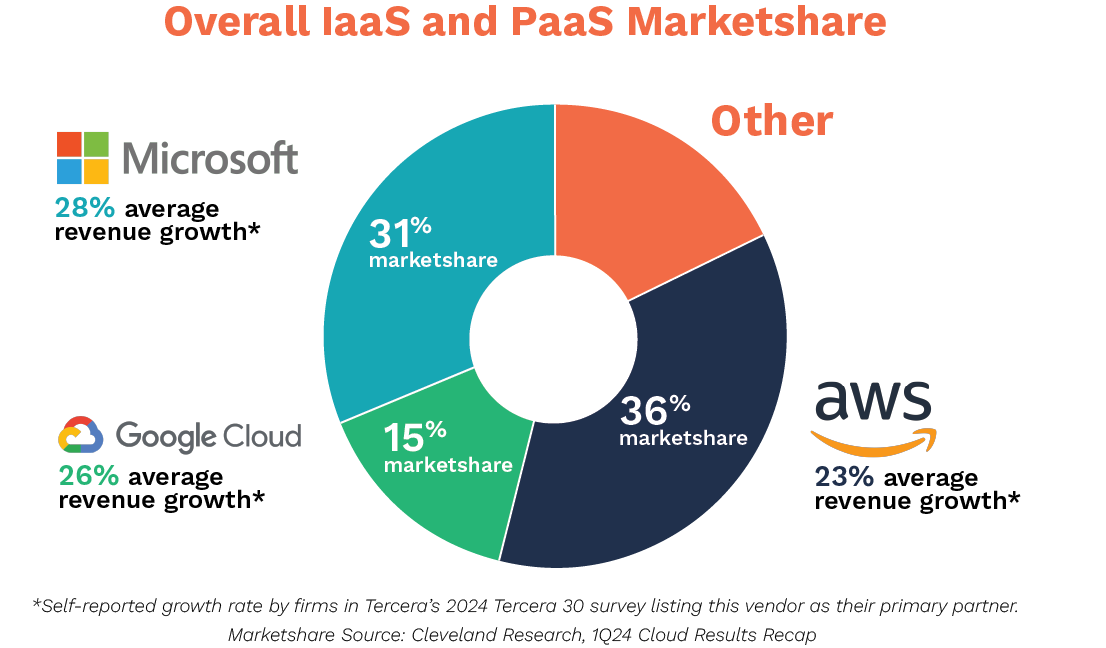

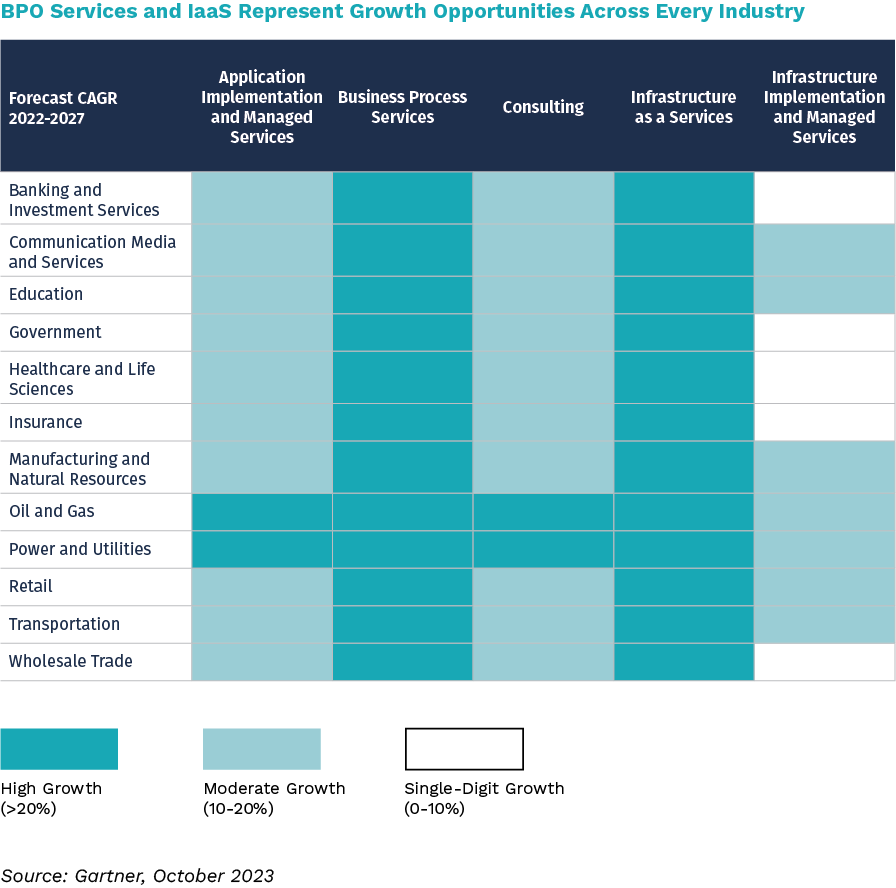

The three largest public cloud providers— Amazon Web Services, Microsoft Azure and Google Cloud — continue to dominate the landscape. Controlling 82% of the Infrastructure-as-a-Service and Platform-as-a-Service market, these three continue to post double-digit year-over-year growth. All on some pretty large numbers.

In the last full fiscal year, AWS saw revenue growth slow to 13% year-over-year, albeit on $90 billion in revenue. Google Cloud, the smallest of the hyperscalers with the last mature partner ecosystem, grew the fastest at 26%, while Microsoft Azure saw nearly 20% growth.

More than half (54%) of the technology services firms we surveyed listed one of these three cloud service providers as their primary partner, and the partners in two of these ecosystems reported higher growth than those in other ecosystems reported.

While much of the standard lift and shift cloud migration work has slowed, major cloud transformation projects are still happening with both large and mid-market customers (often with the hyperscalers funding this work). The most lucrative opportunities for service providers now lie though in cloud-native application development, machine learning and AI.

Consulting firms are also increasingly taking advantage of cloud service provider marketplaces to promote and sell packaged IP and solutions, as customers look to transact through these marketplaces to burn down committed cloud spend.

Firms looking to build new partner motions here may have a hard time breaking in, as these ecosystems are pretty saturated. All three boast thousands of consulting partners, so having a differentiated value proposition for a specific industry, segment or capability will be vital to success.

The shift from on-premise IT to cloud computing has been a great enabler of AI and data modernization. Yet the complexity of moving mission-critical legacy systems fully to the cloud, along with other factors like data sovereignty regulations and the high computation and energy requirements for AI, are now pushing a resurgence in data centers and edge computing.

All this has made hybrid cloud capabilities an increasing requirement for serving enterprise customers, and it’s driving interest in vendors and partners that can work across diverse, complex enterprise architectures. The trend also underpins a few moves on the Tercera 30.

Dynatrace, for example, replaced Datadog on our list. While both vendors provide great observability platforms and are growing well, we believe Dynatrace’s traditional foothold in enterprise IT, ability to monitor both on-prem and cloud environments, and more mature partner motion, may provide greater up-market opportunities for partners.

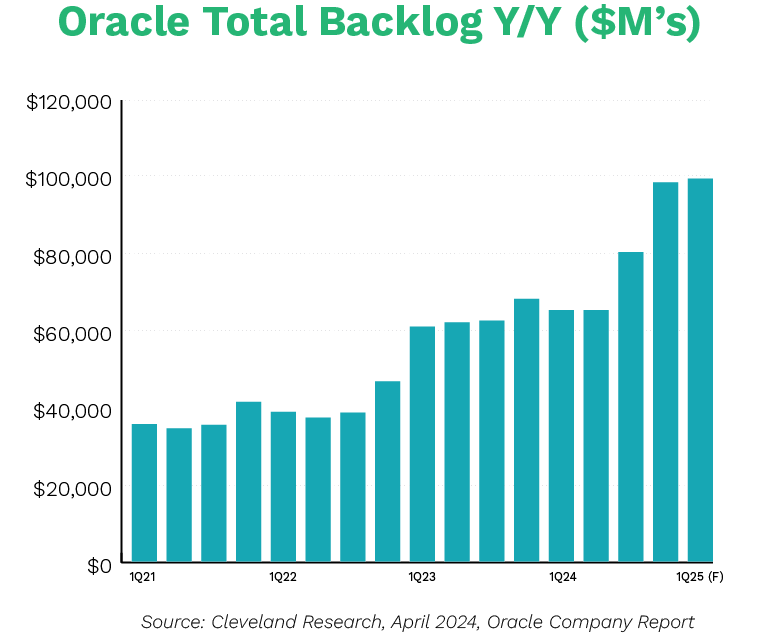

We also saw growth and services demand increase for some legacy vendors, like Oracle and SAP.

Oracle’s hybrid cloud solutions have gained traction, with Oracle Cloud Infrastructure (OCI) revenue expected to grow 50%+ in FY25.

It’s no surprise that the foundational AI companies on our 2023 list — OpenAI and Nvidia — enjoyed another big year. Nvidia alone minted nearly $61 billion in their last full fiscal year!

This performance and the insatiable demand for their offerings, keep both names on the list for 2024, along with the addition of Anthropic, another LLM provider with tight connections to the AWS ecosystem.

Yet it’s still early days and each of these companies is still working out its partner motion, and how they work with consulting partners. However, it’s clear partners are important to their growth strategy, and they’re each making progress. OpenAI has inked resell agreements, Anthropic has announced a number of systems integrator partnerships, and Nvidia is making moves beyond its traditional VAR channel partners as it moves deeper into software.

Establishing a formal partnership with these players will require either a brand name, a pre-existing relationship, or concerted effort (with a little bit of luck). Those who can figure out how to get in early with them may be rewarded, but even as solution partners, these technologies are critical capabilities for any partner looking to be seen as a GenAI leader.

The obsession with AI is creating momentum in other areas as well. According to Hakkoda’s 2024 State of Data Report, 94% of the 500 data leaders polled said they needed to upgrade their data systems this year, in part to fully take advantage of AI. This is driving demand for everything from modern data cloud vendors like Snowflake and Databricks, to data transformation, data science, data security and data resiliency.

However, it could be the hyperscalers— Microsoft, Google, and AWS—that are the real winners in the end. They’re the enablers for both data modernization and AI transformation, and our survey respondents overwhelmingly point to them as the expected AI leaders in the next 1-2 years – well above both OpenAI and Nvidia.

Vertical SaaS companies have been on the rise and on our radar for a number of years. According to Bessemer Venture Partners, these companies already represent a combined market capitalization of ~$300 billion, and the rise of Vertical AI (LLM-native applications that serve specific industry use cases) could create an even bigger addressable market.

It’s interesting to note that seven of the 10 Market Anchors now have verticalized go-to-market strategies. AWS being the most recent field team to verticalize. While industry specialization has long been a means to differentiate with both partners and customers, it’s now a requirement for some of these more mature partner ecosystems.

The desire to apply AI to industry-specific business processes is also pushing the need for partners to hone their vertical expertise. This applies to sectors like financial services, media and retail that have been experimenting with traditional AI and machine learning for decades, but also laggard industries like utilities and healthcare.

It’s why we’ve dedicated this year’s Watch List to a select group of industry solution providers that are not only seeing solid growth but also investing in AI capabilities for future growth. See the Watch List.

Two trends seem to be taking place across the software partners we evaluate for the Tercera 30. First, we’re seeing deeper interconnections across ecosystems. Second, we’re seeing more services partners diversifying their partner networks, creating their own system of Anchors, Movers and Challengers.

When reviewing 150+ partner pages, it’s hard not to notice the overlap between partner ecosystems. Some partners may be more tightly coupled (e.g. Microsoft and Databricks or OpenAI, Google and commercetools or HubSpot, AWS and Snowflake or Anthropic), but you can see many of the Tercera 30 names across dozens of ecosystems. It felt like the CEO of Nvidia, Jensen Huang, made the speaking circuit across the majority of them..

It’s a reminder that even the broadest platform doesn’t stand alone in IT environments – especially as the IT landscape becomes more complex and composable.

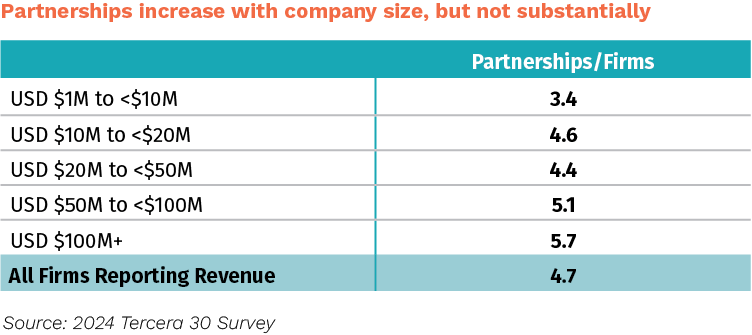

Even pure-play services partners that have adamantly stayed true to one software ecosystem, are starting to expand their own networks of partners. The vast majority of firms already work with multiple partners, and approximately one out five firms say they are looking to enter a new software ecosystem within the next 12 months.

This is partly to spur growth and stay sticky with customers, but also to diversify and manage risk. Being solely tethered to one vendor can be challenging, especially in times of great economic uncertainty and technological change. Services firms can see momentum stall after a partner gets acquired (e.g. HashiCorp), shifts sales motions (e.g. Twilio), cuts resell commissions (e.g. HubSpot) or simply hits a rough patch (e.g. Crowdstrike).

Across our 250+ survey respondents, services partners typically work with between 3 and 6 software firms. Not surprisingly that number increases with company size.

As growth investors, Tercera is always trying to predict where future growth will happen. What we’ve learned, and what our survey respondents reinforced, is that there isn’t one magic segment, market, platform or ecosystem that guarantees IT services partners better growth.

High growth and low growth firms exist in virtually every segment and ecosystem. The fastest growing firms are just as likely to be found in the most saturated ecosystems, as they are in early stage ecosystems. We find fast growers in segments that have slowed, and slow growers in segments that are on fire (like AI).

Growth appears more correlated to firms being hyper focused on the customers they serve and the business problems they solve. Perhaps this is why the vast majority (58%) of survey respondents position themselves as a Solutions Expert rather than an Ecosystem Expert (20%).

This said, some ecosystems do provide more opportunity than others (see takeaway #1). And when you get in and how you play it matters greatly. For example, services firms that get in early with vendors that have high platform demand, can be more single threaded and technology focused. However, as platforms and partner programs mature, partners may need to diversify and get more solutions focused. And within the most mature ecosystems, firms may need to get even more diversified or specialized in a specific industry.

Ultimately, ecosystems matter and the Tercera 30 represent some of the best of the best. However, rapid growth is more a function of being crystal clear on the customer being served, the unique value being delivered, and how well a company executes.

Given the growing importance of verticalization, we’ve dedicated our 2024 Watch List to five Industry Cloud players that performed well across our quantitative scoring and have come up in multiple conversations with industry experts.

Two of these Watch List members – nCino and Veeva – are former Market Movers that continue to capture buyer interest. The three new names – Duck Creek Technologies, Guidewire and Körber – are in segments we believe are ripe for AI disruption (insurance and manufacturing/supply chain).

Most of these already have established partner ecosystems, as well as their own large internal professional services teams (some more than half their revenue). Which means they may require a different partner motion, and a broader array of services. However, these are complex programs that throw off a great deal of services in companies with bigger budgets. For industry specialists who can bring customers and innovation to the table, they could be interesting platforms to build around.

Sector: Insurance

Duck Creek offers cloud-based solutions tailored for the property and casualty (P&C) and general insurance sectors. This privately held company is a spin-off from Accenture, which means the two have a close connection. It competes with publicly-traded insurance specialists Guidewire and Sapiens, both of which have reported moderate growth over the last year.

Sector: Insurance

Guidewire is a platform that helps insurers streamline operations and improve customer experiences. The company went public in 2012 and has continued to grow its footprint over the years with a small but steadily growing partner ecosystem (<50 services partners today). Because of Guidewire’s enterprise client base, we’ve heard skills around this platform are in demand from buyers.

Sector: Manufacturing/Retail

Körber is a global provider of supply chain solutions that specializes in automation, robotics and material handling equipment, with a strong foothold in Europe. The KKR-backed company competes with industry stalwarts like Manhattan Associates, but is thought to have a more partner-friendly go-to-market motion.

Sector: Financial services

nCino is a cloud-based bank operating solution most known for its CRM capabilities and the platform’s ability to automate processes such as loan origination and home lending. nCino’s SI partner ecosystem is small (<30), however, it has continued to grow over the years and nCino’s internal professional services organization is less as a percentage of revenue than many other industry clouds.

Sector: Financial services

Most well known as a cloud-based CRM for pharma companies, Veeva Systems has expanded into business solutions that streamline clinical research, regulatory processes, and quality assurance. Veeva recently replatformed its core CRM product off of Force.com and is looking to migrate all customers to its new platform by 2030, which could spur even more services demand.

Adobe is a global leader in digital marketing and media solutions ranging from design products to digital experience and commerce solutions. Its industrystandard software and cloud-based platform empower creative professionals and businesses to optimize customer engagement and drive business growth.

Adobe is one of the most popular software partners for both IT consultancies and agencies, with close to 1,000 partners. However, Adobe is increasingly facing competition from Canva and an explosion of martech tools, making the space crowded and more challenging for specialist partners. Indeed, the ecosystem has contracted 7% since 2023. Services around Adobe Experience Cloud, its new GenStudio platform, and/or Firefly Services remain in demand.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Amazon Web Services provides a broad range of cloud computing infrastructure, platforms and services to individuals, companies and governments. As the world’s most comprehensive and widely adopted cloud platform, AWS is used by businesses of all sizes to deploy, manage and scale all manner of applications and services.

AWS remains the largest cloud service provider, and has one of the largest and fastest growing partner ecosystems. The most common partner competencies here are migration and DevOps. While the company is starting to see backlog slowing, and its market dominance being challenged, partners within this ecosystem continue to report increasing demand for its offerings. It is also considered one of the most partner friendly, with AWS even offering to help fund workload migration and AI projects.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Google Cloud is a Cloud Service Provider known for its strengths in data analytics, machine learning and opensource technologies. While Google may be the smallest of the IaaS and PaaS providers, it’s considered to be a leader in AI due to its extensive R&D investments here and decades long expertise processing large datasets. Google claims to be the “the most open platform” when it comes to AI, offering both first-party and third-party models.

Google Cloud revenue is growing faster than both AWS and Microsoft, and it has a less saturated partner ecosystem than the other hyperscalers. While this can spell opportunity for new and existing partners, it’s also worth noting that Google as a company is still far less mature when it comes to partnering and enterprise selling. They have been improving, and the company has gone on the record saying channel partners will lead the way in the company’s AI push.

Level of services intensity: Medium to high

Maturity of partner ecosystem: Growth

Microsoft’s cloud business includes Azure, a cloud computing platform with more than 200 products and services that help companies build, run and manage applications across clouds. It also includes a number of server and software development solutions (e.g. GitHub) that many enterprises use and trust. Microsoft Azure is well known for business productivity, business intelligence and security software, and its growing investments in AI.

Microsoft has seen significant growth across both its Azure platform and in other areas such as security and AI co-pilots. Microsoft has one of the largest, most saturated and most complex partner ecosystems of all the Tercera 30, which can make it a tough ecosystem to break into. However, for established partners or those that bring something unique to the table, Microsoft’s broad and deep portfolio of products and it’s growing lead in AI (through OpenAI and its own developments) offer tremendous opportunity.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Responsible for inventing the database software category, Oracle maintains a strong and steady presence in enterprise software. Once a laggard in IT’s move to the cloud, Oracle has invested heavily in its Oracle Cloud Infrastructure (OCI) offerings, and it is now considered to be the fourth largest hyperscaler with 3-4% of the market.

Oracle’s ability to support both on-premise and cloud systems has spurred growth for its OCI offerings in recent years. Its partner ecosystem is once again growing, along with its backlog and share of the market. However, this is still a tough ecosystem to break into with lots of established partners, and some survey respondents suggest that working with the company can be challenging. Nevertheless, demand is increasing for partners with AI and hybrid capabilities, as well as vertical specialists serving the federal space.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Salesforce is the leading customer relationship management (CRM) platform with 21% share of a very fragmented market. Over the years, Salesforce has grown far beyond a simple CRM provider, expanding its offerings across commerce, integration, custom development, data, AI and different industry clouds. Despite being nearly $34 billion in revenue, the organization continues to grow, even if it is at a slower rate.

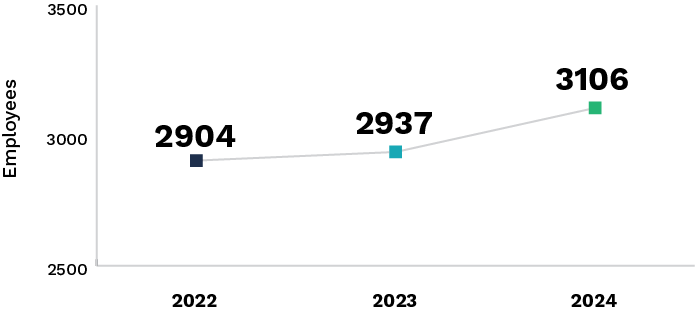

The Salesforce partner ecosystem continues to defy the law of large numbers. With almost 3,000 services partners, the partner ecosystem continues to expand year-over-year by more than 20% and the GSIs continue to grow their multi-billion dollar practices. Salesforce is one of the most popular ecosystems with 30% of our survey respondents working within it. While saturated, Salesforce’s partner centricity makes it a great place to play. This is especially true of industry specialists and those who can help Salesforce drive its Data Cloud — a huge area of focus.

Level of services intensity: Medium to High

Maturity of partner ecosystem: Mature

SAP is a multinational software corporation best known for Enterprise Resource Planning (ERP) software and its Database-as-a-Service, HANA. SAP’s solutions enable companies to integrate processes across the enterprise and use real-time data to drive better decision-making.

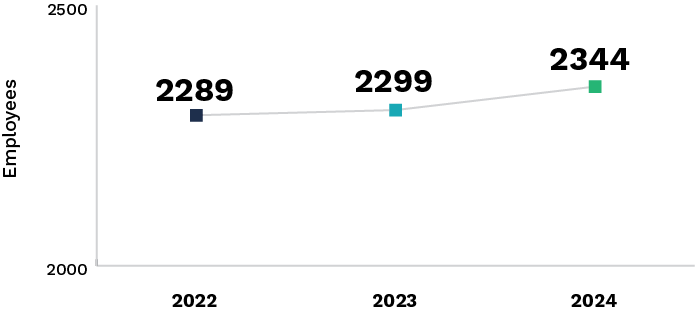

SAP and its partner ecosystem continue to see growth, albeit at a slower pace than other Market Anchors. Regardless, the product is extremely sticky and firmly entrenched in global enterprises, and it remains one of the top 10 ecosystems in our survey in terms of the number of respondents partnered with the company. The S/4 HANA migration is driving significant demand for SAP skills as the company sunsets the older version of its platform and ends support for thousands of large customers in 2027.

Level of services intensity: High

Maturity of partner ecosystem: Mature

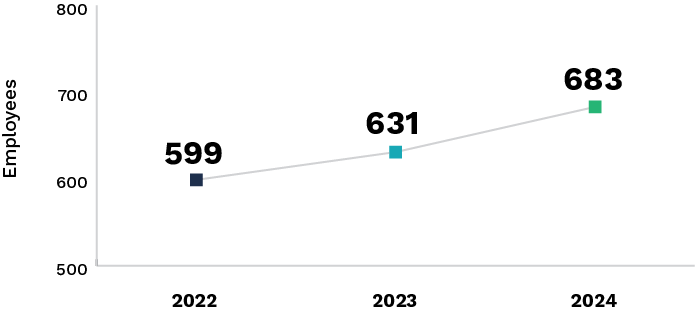

ServiceNow has long been a leader in the IT Services Management (ITSM) space, but its broader Now Platform is now used by 85% of the Fortune 500 to enhance operational efficiency, improve employee experiences and streamline digital workflows using AI. It has nearly quadrupled the number of products in its portfolio in the last few years and leaned in hard with partners as part of its growth strategy.

Consistent growth, a thriving partner ecosystem, and a growing portfolio of offerings has made ServiceNow a go-to partner for a growing number of service providers. While there’s been a lot of consolidation in the partner ecosystem with GSIs looking to build billion-dollar ServiceNow practices, there still seems to be room to play for newer entrants — especially in certain geographies and industries. Learn more about their partner program here.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Snowflake is a cloud-based data platform that enables businesses to store, process and analyze massive amounts of data in a single, unified environment. Snowflake was the first platform that allowed enterprises to separate storage from compute, and has seen tremendous growth over the last few years. It is the smallest of the Market Anchors.

Snowflake and its partners have benefited from an increasing demand for all things data. With a wellstructured, tiered partner program, Snowflake’s partner ecosystem has seen controlled growth of nearly 20% since last year. With the GSIs expanding their footprint here, there’s a growing focus on partners that can do more than just migrate data, but instead drive value and usage of the platform. Competition with Databricks and other AI-optimized data players is heating up, but Snowflake remains one of the most in-demand partners.

Learn more about their partner program here.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Workday is a cloud-based enterprise software provider that specializes in human capital management (HCM), financial management and enterprise resource planning (ERP). It offers organizations a unified solution for managing financial and employee data, helping businesses streamline processes and improve decision-making in real-time.

Workday has finally opened up its tightly controlled partner ecosystem, with the number of partners growing 46% year-over-year since our last report. However, Workday’s revenue growth has not seen the same dramatic upward trend as the company faces increased competition and a level of saturation within the largest enterprises. But for services firms that target HR and talent transformation, Workday remains a solid partner.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Atlassian is a leading provider of collaboration software designed for high performing teams. Best known for products like Jira, Confluence and Trello, Atalssian tools empower teams to plan, track and execute work more efficiently, driving productivity across the enterprise.

Atlassian goes to market almost exclusively through its channel partners. The software company’s consistently strong revenue growth and partner centricity, are driving significant opportunity for services partners. Atlassian is looking for partners that can not only help migrate existing on-premise customers to the cloud, but can also help enterprise customers with wallto-wall expansion across a growing product portfolio. Learn more about the partner ecosystem here.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

Braze is a customer engagement and marketing automation platform that enables brands to create personalized interactions with their customers across multiple channels, including mobile, web, email and SMS. By leveraging real-time data, Braze helps companies deliver relevant messaging and drive customer loyalty and retention.

Braze is one of many players in the martech space, but has carved out an enviable niche, growing faster than many other vendors. It’s done this partly by putting partners at the center of its growth strategy. It has strengthened relationships with GSIs as well as specialist partners and agencies, many of these partners of other larger vendors like Adobe, Shopify and Salesforce. Projects can be smaller than traditional martech projects, but can be a good entry to providing a broader set of services.

Level of services intensity: Low

Maturity of partner ecosystem: Growth

Dynatrace is a software intelligence platform that provides end-to-end visibility and analytics into application performance, infrastructure and user experience. Dynatrace leverages AI and automation to help organizations optimize both their cloud and onpremise environments and address any issues before they impact users.

A newcomer to our list in 2024 but a player in the space for many years, Dynatrace boasts a larger, more mature partner channel compared to newer competitors like Datadog. Its ability to span both traditional IT and cloud environments allows Dynatrace to serve larger enterprises, with partners playing a big role in deals and influencing new business. Partner deal involvement jumped from 59% to 65% in the past year, according to comments shared by the company.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

MongoDB is a developer-centric database platform offering a flexible and scalable approach to handling and storing data that’s well suited to enterprises with hybrid IT environments. MongoDB is a NoSQL database known for its document-oriented design, which allows developers to work with data in a way that is intuitive and aligns with modern application development needs.

A member of last year’s Watch List, MongoDB has grown its market share from the ground up and continues to lean into its services partners to fuel continued growth. Some services firms say it can be challenging to collaborate due to MongoDB’s specialized nature. However, MongoDB is capturing interest with its open source, customer choice mentality and its work in AI. It holds potential as an adjacent ecosystem for services providers focused on digital engineering or doing extensive works with the hyperscalers.

Level of services intensity: Low

Maturity of partner ecosystem: Growth

Nvidia designs and manufactures high performance graphics processing units (GPUs) and related software. Nvidia’s technology is now embedded across various industries, used for everything from developing AI solutions to gaming to autonomous vehicles. Nvidia is looking to move up the stack from chips, delving deeper into everything from software that powers ML applications on Nvidia hardware to data and AI strategy.

Nvidia has seen tremendous growth over the last two years, but its goto-market and partner organizations are smaller than one might expect at its size. Nvidia has focused much of its partnership power on the large VARs and a handful of GSIs (with Deloitte being the furthest along), but its move up the stack and deepening relationships with data and cloud service providers could make it a natural expansion area for partners in those partner ecosystems. It’s early days, and we’ll be watching how things evolve.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Okta is a leading provider of identity and access management solutions, offering a cloud-based platform that secures user authentication into applications and devices. It enables organizations to manage and protect user identities, providing seamless access to technology that secures critical resources from cloud to ground for the workforce and customers.

Okta is an entrenched player in the identity management space. Okta is most well known for its workforce identity product but has since expanded into other areas such as Privileged Access Management (PAM) and Identity Governance. It appears to have a renewed focus on its partners, a welcome change to many that cited growing competition with its own internal professional services organization.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

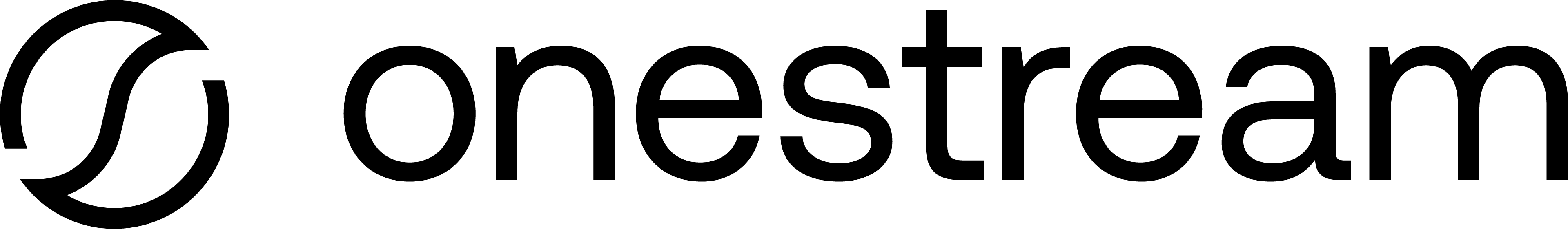

OneStream is a unified, cloud-based enterprise finance platform that unifies financial and operational data for more accurate and efficient enterprise planning. It simplifies processes such as consolidation, planning, reporting and analytics, embedding ML and AI to improve productivity and support decision making.

OneStream moved from our private Market Challenger list to the publicly-traded Market Movers group after its successful IPO in July. The company is well-positioned to capitalize on opportunities in finance AI transformation, making it an attractive option for partners focused on innovation in this space. The company chooses to go deep rather than wide with its partners. It’s one of the more challenging ecosystems to break into, but service providers who make it in enjoy one-to-one partner support and ample opportunity to thrive. Learn more about the partner ecosystem here.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Palo Alto Networks is a global cybersecurity company specializing in advanced threat prevention and network security. Palo Alto offers a range of products and services, including firewalls, cloud security and endpoint protection. It has done an admirable job diversifying from its legacy appliance products, and is one of the security players that appears to be benefiting from the consolidation in security

Palo Alto Network is well positioned to be one of the consolidators in the cyber space, with broad product set and tight relationships with security buyers. Palo Alto Network’s large internal professional services team and existing partner network can make it challenging for services partners and MSSPs to find meaningful opportunities. But as the cybersecurity solution company moves into new offerings and a new era of growth, it appears to be leaning more heavily into partners.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Shopify is an e-commerce platform that helps businesses of all sizes to create, manage and grow their online stores. Shopify is known for empowering entrepreneurs to sell products directly to consumers around the world. However, Shopify+ is making a concerted move into the enterprise space and opening up the market with a new focus on headless and composable commerce.

With 26% growth, Shopify has defied some of the headwinds that others in the commerce space have experienced, putting pressure on many of the older, monolithic commerce players. In the past, Shopify has focused on building a large and loyal community of independent consultancies, boutique agencies, and freelancers to address customer needs. As it moves upmarket, there may be room for bigger SIs within the ecosystem.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Zscaler is the defacto player in the Secure Access Service Edge, or SASE, space, which combines network and security services into a single solution. With its zerotrust architecture, Zscaler helps users safely connect to applications from any location, on any device.

With leadership coming in from partner-obsessed companies like ServiceNow, Salesforce and Microsoft, Zscaler is leaning more into its partner ecosystem than it has in the past, putting it on the Tercera 30 for the first time. The company has increased investments in both the GSIs and smaller specialists who are able to handle implementations and post implementation managed services. While competition is intensifying in the SASE space, Zscaler seems well positioned to be one of the winners here.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

Anthropic is an AI platform and research company founded by former OpenAI researchers, and is the creator of the popular Claude family of AI language models. Over the last year, this relative start-up has tripled in valuation, hitting roughly $15 billion by some accounts, with investments from three of the Tercera 30 Anchors — Google, AWS and Salesforce.

A new member of the Tercera 30, Anthropic is in the early stages of figuring out how to engage its partner ecosystem, but it certainly has momentum. Its partner program already includes GSIs such as Accenture and BCG as well as a handful of smaller firms with ties to the AWS ecosystem. A number of former Stripe executives have joined Anthropic’s go-to-market team and are bringing a partner mindset to the firm, even if it is early days.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Celonis is a market leader in process mining and execution management, helping companies visualize and improve their business processes. Its platform provides real-time insights and actionable recommendations that drive operational efficiency and business transformation.

While process mining may have lost a bit of its initial magic, we still see potential in how the Celonis technology compliments and aligns with AI-enabled optimization. Celonis also continues to maintain close ties with SAP and several GSIs, with many SAP customers using Celonis as well. Overall, the partner ecosystem is still growing (34% growth over the last year) as Celonis and its partners look to use process mining for business transformation.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Cohesity offers a data management platform that simplifies the protection, management and value extraction of enterprise data. By consolidating data silos and integrating with hybrid cloud environments, Cohesity enables organizations to streamline backup, recovery and data insights.

Enterprises are increasing their investment in data resiliency for a number of reasons, from protecting themselves from a rise in cyber attacks and ransomware to overall business continuity and compliance. Cohesity, which has seen investment from the likes of Sequoia and Nvidia, has benefitted nicely from this trend, earning it a spot on the Tercera 30. The Cohesity partner ecosystem has grown 62% year over year, and is now slightly larger than its publicly traded competitor, Rubrik.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

commercetools originated the term headless and is the leading enterprise-focused composable commerce platform on the market today. It offers an API-first portfolio of cloud-native solutions that decouple the front-end and back-end of e-commerce applications for highly customized commerce experiences, while maintaining the agility to adapt to market changes.

commercetools is seeing more competition these days from the likes of Salesforce and Shopify, both of which have touted their headless offerings. However, it remains the go-to composable player for larger brands looking to modernize their commerce stack. In the last year, the company has seen greater traction in B2B and the North and Latin American markets, a move which should continue under the leadership of its new CEO. With rumors of a pending IPO, we expect continued growth for both the company and its diverse partner ecosystem.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Contentstack is a headless Content Management System (CMS) platform that allows marketers and developers to create, manage and deliver content across any digital channel simultaneously. Contentstack has gained traction with larger enterprises that have complex needs. It’s a close partner with some of the largest CRM, Digital Experience and Commerce providers.

With enterprise IT becoming increasingly composable and headless going mainstem, Contentstack is grabbing larger CMS deals, and its previously nascent partner ecosystem is growing by leaps and bounds as a result. Service partners with expertise in customizing e-commerce and customer experience solutions will be a great fit for this ecosystem. They can expect to see increasing demand for services as companies aim to become more agile, flexible and scalable in their customer experience solutions.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Databricks is a data and analytics platform that enables organizations to work effectively on big data, machine learning and AI initiatives. Built on Apache Spark, Databricks integrates data engineering, science and analytics into one environment. Considered a platform built by and for data scientists, Databricks is one of the leading platforms for AI and has seen tremendous growth (and interest from partners) as a result.

Databricks is in a head-to-head battle for data supremacy with Snowflake, and pushes its partners to choose between the two (even if many customers have both in their environment). Databricks has a large partner ecosystem that it is starting to put more structure around. However, its partner coselling motion remains a work in progress. Databricks has been a natural adjacent partnership for many Microsoft partners, although competition is starting to heat up there as well.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Fluent Commerce is a cloud-native distributed order management platform that helps retailers and brands optimize inventory, orders and fulfillment across multiple channels. Its solution enables businesses to deliver a seamless omnichannel shopping experience, improving customer satisfaction and operational efficiency.

Fluent offers a compelling alternative to traditional, complex ERP-like implementations like Manhattan. While still relatively small, the company’s early focus on composability aligns well with current retail market trends. Fluent expanded its partner ecosystem by 20% in the past year and has attracted an impressive number of GSIs as top partners.

Level of services intensity: High

Maturity of partner ecosystem: Growth

OpenAI is a leading artificial intelligence research organization focused on creating and promoting friendly AI for the benefit of all humanity. Known for its advanced models like GPT, OpenAI develops cuttingedge technologies that push the boundaries of machine learning, natural language processing and robotics.

OpenAI and its ChatGPT LLM continues to hold much of the mindshare in the AI space. It’s seeing more pressure in the enterprise from other players like Anthropic, and even its strategic partner Microsoft. However, ChatGPT Enterprise is now being used across hundreds of thousands of use cases. OpenAI’s partner motion remains less focused on service providers than other partnerships, however, its market dominance and new resell program has attracted notable GSIs including PwC, Accenture, and SHI.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Stripe is a leading financial infrastructure platform that enables businesses of all sizes to accept payments, manage revenue and handle financial transactions online. With a suite of APIs and tools, Stripe simplifies complex financial processes, helping companies scale and manage their online commerce operations globally.

Stripe’s valuation has rebounded nicely in the past year while many of its fintech peers face down rounds, showcasing its market dominance in the financial infrastructure space. We’ve seen the technology grow from a developer tool into a bonafide platform with multiple offerings, resulting in some larger payment transformation engagements. GSI relationships with PWC, Deloitte, Infosys, and others have expanded accordingly. There are a few specialized service partners in the ecosystem, but most see Stripe as an adjacent technology to a CRM, e-commerce platform or ERP. That may change as Stripe continues to move up market.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

Wiz is a cloud security platform that provides realtime visibility and risk assessment across cloud environments. It helps organizations detect, prioritize and mitigate security threats in multi-cloud and hybrid cloud infrastructures, ensuring compliance and data protection.

Wiz’s explosive growth has garnered a lot of market and customer attention over the last few years, with rumors the company is headed toward a possible IPO. Because the solution is easy to implement, there’s less upfront work for partners. The services opportunity comes when the solution identifies vulnerabilities that need remediating. Traditionally, Wiz has focused on partnering with VARs, but it’s looking to add security partners and MSSPs that are ready to expand their security offerings and capitalize on the booming cloud security market.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

Adobe is a global leader in digital marketing and media solutions ranging from design products to digital experience and commerce solutions. Its industrystandard software and cloud-based platform empower creative professionals and businesses to optimize customer engagement and drive business growth.

Adobe is one of the most popular software partners for both IT consultancies and agencies, with close to 1,000 partners. However, Adobe is increasingly facing competition from Canva and an explosion of martech tools, making the space crowded and more challenging for specialist partners. Indeed, the ecosystem has contracted 7% since 2023. Services around Adobe Experience Cloud, its new GenStudio platform, and/or Firefly Services remain in demand.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Amazon Web Services provides a broad range of cloud computing infrastructure, platforms and services to individuals, companies and governments. As the world’s most comprehensive and widely adopted cloud platform, AWS is used by businesses of all sizes to deploy, manage and scale all manner of applications and services.

AWS remains the largest cloud service provider, and has one of the largest and fastest growing partner ecosystems. The most common partner competencies here are migration and DevOps. While the company is starting to see backlog slowing, and its market dominance being challenged, partners within this ecosystem continue to report increasing demand for its offerings. It is also considered one of the most partner friendly, with AWS even offering to help fund workload migration and AI projects.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Google Cloud is a Cloud Service Provider known for its strengths in data analytics, machine learning and opensource technologies. While Google may be the smallest of the IaaS and PaaS providers, it’s considered to be a leader in AI due to its extensive R&D investments here and decades long expertise processing large datasets. Google claims to be the “the most open platform” when it comes to AI, offering both first-party and third-party models.

Google Cloud revenue is growing faster than both AWS and Microsoft, and it has a less saturated partner ecosystem than the other hyperscalers. While this can spell opportunity for new and existing partners, it’s also worth noting that Google as a company is still far less mature when it comes to partnering and enterprise selling. They have been improving, and the company has gone on the record saying channel partners will lead the way in the company’s AI push.

Level of services intensity: Medium to high

Maturity of partner ecosystem: Growth

Microsoft’s cloud business includes Azure, a cloud computing platform with more than 200 products and services that help companies build, run and manage applications across clouds. It also includes a number of server and software development solutions (e.g. GitHub) that many enterprises use and trust. Microsoft Azure is well known for business productivity, business intelligence and security software, and its growing investments in AI.

Microsoft has seen significant growth across both its Azure platform and in other areas such as security and AI co-pilots. Microsoft has one of the largest, most saturated and most complex partner ecosystems of all the Tercera 30, which can make it a tough ecosystem to break into. However, for established partners or those that bring something unique to the table, Microsoft’s broad and deep portfolio of products and it’s growing lead in AI (through OpenAI and its own developments) offer tremendous opportunity.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Responsible for inventing the database software category, Oracle maintains a strong and steady presence in enterprise software. Once a laggard in IT’s move to the cloud, Oracle has invested heavily in its Oracle Cloud Infrastructure (OCI) offerings, and it is now considered to be the fourth largest hyperscaler with 3-4% of the market.

Oracle’s ability to support both on-premise and cloud systems has spurred growth for its OCI offerings in recent years. Its partner ecosystem is once again growing, along with its backlog and share of the market. However, this is still a tough ecosystem to break into with lots of established partners, and some survey respondents suggest that working with the company can be challenging. Nevertheless, demand is increasing for partners with AI and hybrid capabilities, as well as vertical specialists serving the federal space.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Salesforce is the leading customer relationship management (CRM) platform with 21% share of a very fragmented market. Over the years, Salesforce has grown far beyond a simple CRM provider, expanding its offerings across commerce, integration, custom development, data, AI and different industry clouds. Despite being nearly $34 billion in revenue, the organization continues to grow, even if it is at a slower rate.

The Salesforce partner ecosystem continues to defy the law of large numbers. With almost 3,000 services partners, the partner ecosystem continues to expand year-over-year by more than 20% and the GSIs continue to grow their multi-billion dollar practices. Salesforce is one of the most popular ecosystems with 30% of our survey respondents working within it. While saturated, Salesforce’s partner centricity makes it a great place to play. This is especially true of industry specialists and those who can help Salesforce drive its Data Cloud — a huge area of focus.

Level of services intensity: Medium to High

Maturity of partner ecosystem: Mature

SAP is a multinational software corporation best known for Enterprise Resource Planning (ERP) software and its Database-as-a-Service, HANA. SAP’s solutions enable companies to integrate processes across the enterprise and use real-time data to drive better decision-making.

SAP and its partner ecosystem continue to see growth, albeit at a slower pace than other Market Anchors. Regardless, the product is extremely sticky and firmly entrenched in global enterprises, and it remains one of the top 10 ecosystems in our survey in terms of the number of respondents partnered with the company. The S/4 HANA migration is driving significant demand for SAP skills as the company sunsets the older version of its platform and ends support for thousands of large customers in 2027.

Level of services intensity: High

Maturity of partner ecosystem: Mature

ServiceNow has long been a leader in the IT Services Management (ITSM) space, but its broader Now Platform is now used by 85% of the Fortune 500 to enhance operational efficiency, improve employee experiences and streamline digital workflows using AI. It has nearly quadrupled the number of products in its portfolio in the last few years and leaned in hard with partners as part of its growth strategy.

Consistent growth, a thriving partner ecosystem, and a growing portfolio of offerings has made ServiceNow a go-to partner for a growing number of service providers. While there’s been a lot of consolidation in the partner ecosystem with GSIs looking to build billion-dollar ServiceNow practices, there still seems to be room to play for newer entrants — especially in certain geographies and industries. Learn more about their partner program here.

Level of services intensity: High

Maturity of partner ecosystem: Mature

Snowflake is a cloud-based data platform that enables businesses to store, process and analyze massive amounts of data in a single, unified environment. Snowflake was the first platform that allowed enterprises to separate storage from compute, and has seen tremendous growth over the last few years. It is the smallest of the Market Anchors.

Snowflake and its partners have benefited from an increasing demand for all things data. With a wellstructured, tiered partner program, Snowflake’s partner ecosystem has seen controlled growth of nearly 20% since last year. With the GSIs expanding their footprint here, there’s a growing focus on partners that can do more than just migrate data, but instead drive value and usage of the platform. Competition with Databricks and other AI-optimized data players is heating up, but Snowflake remains one of the most in-demand partners.

Learn more about their partner program here.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Workday is a cloud-based enterprise software provider that specializes in human capital management (HCM), financial management and enterprise resource planning (ERP). It offers organizations a unified solution for managing financial and employee data, helping businesses streamline processes and improve decision-making in real-time.

Workday has finally opened up its tightly controlled partner ecosystem, with the number of partners growing 46% year-over-year since our last report. However, Workday’s revenue growth has not seen the same dramatic upward trend as the company faces increased competition and a level of saturation within the largest enterprises. But for services firms that target HR and talent transformation, Workday remains a solid partner.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Atlassian is a leading provider of collaboration software designed for high performing teams. Best known for products like Jira, Confluence and Trello, Atalssian tools empower teams to plan, track and execute work more efficiently, driving productivity across the enterprise.

Atlassian goes to market almost exclusively through its channel partners. The software company’s consistently strong revenue growth and partner centricity, are driving significant opportunity for services partners. Atlassian is looking for partners that can not only help migrate existing on-premise customers to the cloud, but can also help enterprise customers with wallto-wall expansion across a growing product portfolio. Learn more about the partner ecosystem here.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

Braze is a customer engagement and marketing automation platform that enables brands to create personalized interactions with their customers across multiple channels, including mobile, web, email and SMS. By leveraging real-time data, Braze helps companies deliver relevant messaging and drive customer loyalty and retention.

Braze is one of many players in the martech space, but has carved out an enviable niche, growing faster than many other vendors. It’s done this partly by putting partners at the center of its growth strategy. It has strengthened relationships with GSIs as well as specialist partners and agencies, many of these partners of other larger vendors like Adobe, Shopify and Salesforce. Projects can be smaller than traditional martech projects, but can be a good entry to providing a broader set of services.

Level of services intensity: Low

Maturity of partner ecosystem: Growth

Dynatrace is a software intelligence platform that provides end-to-end visibility and analytics into application performance, infrastructure and user experience. Dynatrace leverages AI and automation to help organizations optimize both their cloud and onpremise environments and address any issues before they impact users.

A newcomer to our list in 2024 but a player in the space for many years, Dynatrace boasts a larger, more mature partner channel compared to newer competitors like Datadog. Its ability to span both traditional IT and cloud environments allows Dynatrace to serve larger enterprises, with partners playing a big role in deals and influencing new business. Partner deal involvement jumped from 59% to 65% in the past year, according to comments shared by the company.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

MongoDB is a developer-centric database platform offering a flexible and scalable approach to handling and storing data that’s well suited to enterprises with hybrid IT environments. MongoDB is a NoSQL database known for its document-oriented design, which allows developers to work with data in a way that is intuitive and aligns with modern application development needs.

A member of last year’s Watch List, MongoDB has grown its market share from the ground up and continues to lean into its services partners to fuel continued growth. Some services firms say it can be challenging to collaborate due to MongoDB’s specialized nature. However, MongoDB is capturing interest with its open source, customer choice mentality and its work in AI. It holds potential as an adjacent ecosystem for services providers focused on digital engineering or doing extensive works with the hyperscalers.

Level of services intensity: Low

Maturity of partner ecosystem: Growth

Nvidia designs and manufactures high performance graphics processing units (GPUs) and related software. Nvidia’s technology is now embedded across various industries, used for everything from developing AI solutions to gaming to autonomous vehicles. Nvidia is looking to move up the stack from chips, delving deeper into everything from software that powers ML applications on Nvidia hardware to data and AI strategy.

Nvidia has seen tremendous growth over the last two years, but its goto-market and partner organizations are smaller than one might expect at its size. Nvidia has focused much of its partnership power on the large VARs and a handful of GSIs (with Deloitte being the furthest along), but its move up the stack and deepening relationships with data and cloud service providers could make it a natural expansion area for partners in those partner ecosystems. It’s early days, and we’ll be watching how things evolve.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Okta is a leading provider of identity and access management solutions, offering a cloud-based platform that secures user authentication into applications and devices. It enables organizations to manage and protect user identities, providing seamless access to technology that secures critical resources from cloud to ground for the workforce and customers.

Okta is an entrenched player in the identity management space. Okta is most well known for its workforce identity product but has since expanded into other areas such as Privileged Access Management (PAM) and Identity Governance. It appears to have a renewed focus on its partners, a welcome change to many that cited growing competition with its own internal professional services organization.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

OneStream is a unified, cloud-based enterprise finance platform that unifies financial and operational data for more accurate and efficient enterprise planning. It simplifies processes such as consolidation, planning, reporting and analytics, embedding ML and AI to improve productivity and support decision making.

OneStream moved from our private Market Challenger list to the publicly-traded Market Movers group after its successful IPO in July. The company is well-positioned to capitalize on opportunities in finance AI transformation, making it an attractive option for partners focused on innovation in this space. The company chooses to go deep rather than wide with its partners. It’s one of the more challenging ecosystems to break into, but service providers who make it in enjoy one-to-one partner support and ample opportunity to thrive. Learn more about the partner ecosystem here.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Palo Alto Networks is a global cybersecurity company specializing in advanced threat prevention and network security. Palo Alto offers a range of products and services, including firewalls, cloud security and endpoint protection. It has done an admirable job diversifying from its legacy appliance products, and is one of the security players that appears to be benefiting from the consolidation in security

Palo Alto Network is well positioned to be one of the consolidators in the cyber space, with broad product set and tight relationships with security buyers. Palo Alto Network’s large internal professional services team and existing partner network can make it challenging for services partners and MSSPs to find meaningful opportunities. But as the cybersecurity solution company moves into new offerings and a new era of growth, it appears to be leaning more heavily into partners.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Shopify is an e-commerce platform that helps businesses of all sizes to create, manage and grow their online stores. Shopify is known for empowering entrepreneurs to sell products directly to consumers around the world. However, Shopify+ is making a concerted move into the enterprise space and opening up the market with a new focus on headless and composable commerce.

With 26% growth, Shopify has defied some of the headwinds that others in the commerce space have experienced, putting pressure on many of the older, monolithic commerce players. In the past, Shopify has focused on building a large and loyal community of independent consultancies, boutique agencies, and freelancers to address customer needs. As it moves upmarket, there may be room for bigger SIs within the ecosystem.

Level of services intensity: Medium

Maturity of partner ecosystem: Mature

Zscaler is the defacto player in the Secure Access Service Edge, or SASE, space, which combines network and security services into a single solution. With its zerotrust architecture, Zscaler helps users safely connect to applications from any location, on any device.

With leadership coming in from partner-obsessed companies like ServiceNow, Salesforce and Microsoft, Zscaler is leaning more into its partner ecosystem than it has in the past, putting it on the Tercera 30 for the first time. The company has increased investments in both the GSIs and smaller specialists who are able to handle implementations and post implementation managed services. While competition is intensifying in the SASE space, Zscaler seems well positioned to be one of the winners here.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

Anthropic is an AI platform and research company founded by former OpenAI researchers, and is the creator of the popular Claude family of AI language models. Over the last year, this relative start-up has tripled in valuation, hitting roughly $15 billion by some accounts, with investments from three of the Tercera 30 Anchors — Google, AWS and Salesforce.

A new member of the Tercera 30, Anthropic is in the early stages of figuring out how to engage its partner ecosystem, but it certainly has momentum. Its partner program already includes GSIs such as Accenture and BCG as well as a handful of smaller firms with ties to the AWS ecosystem. A number of former Stripe executives have joined Anthropic’s go-to-market team and are bringing a partner mindset to the firm, even if it is early days.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Celonis is a market leader in process mining and execution management, helping companies visualize and improve their business processes. Its platform provides real-time insights and actionable recommendations that drive operational efficiency and business transformation.

While process mining may have lost a bit of its initial magic, we still see potential in how the Celonis technology compliments and aligns with AI-enabled optimization. Celonis also continues to maintain close ties with SAP and several GSIs, with many SAP customers using Celonis as well. Overall, the partner ecosystem is still growing (34% growth over the last year) as Celonis and its partners look to use process mining for business transformation.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Cohesity offers a data management platform that simplifies the protection, management and value extraction of enterprise data. By consolidating data silos and integrating with hybrid cloud environments, Cohesity enables organizations to streamline backup, recovery and data insights.

Enterprises are increasing their investment in data resiliency for a number of reasons, from protecting themselves from a rise in cyber attacks and ransomware to overall business continuity and compliance. Cohesity, which has seen investment from the likes of Sequoia and Nvidia, has benefitted nicely from this trend, earning it a spot on the Tercera 30. The Cohesity partner ecosystem has grown 62% year over year, and is now slightly larger than its publicly traded competitor, Rubrik.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

commercetools originated the term headless and is the leading enterprise-focused composable commerce platform on the market today. It offers an API-first portfolio of cloud-native solutions that decouple the front-end and back-end of e-commerce applications for highly customized commerce experiences, while maintaining the agility to adapt to market changes.

commercetools is seeing more competition these days from the likes of Salesforce and Shopify, both of which have touted their headless offerings. However, it remains the go-to composable player for larger brands looking to modernize their commerce stack. In the last year, the company has seen greater traction in B2B and the North and Latin American markets, a move which should continue under the leadership of its new CEO. With rumors of a pending IPO, we expect continued growth for both the company and its diverse partner ecosystem.

Level of services intensity: High

Maturity of partner ecosystem: Growth

Contentstack is a headless Content Management System (CMS) platform that allows marketers and developers to create, manage and deliver content across any digital channel simultaneously. Contentstack has gained traction with larger enterprises that have complex needs. It’s a close partner with some of the largest CRM, Digital Experience and Commerce providers.

With enterprise IT becoming increasingly composable and headless going mainstem, Contentstack is grabbing larger CMS deals, and its previously nascent partner ecosystem is growing by leaps and bounds as a result. Service partners with expertise in customizing e-commerce and customer experience solutions will be a great fit for this ecosystem. They can expect to see increasing demand for services as companies aim to become more agile, flexible and scalable in their customer experience solutions.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Databricks is a data and analytics platform that enables organizations to work effectively on big data, machine learning and AI initiatives. Built on Apache Spark, Databricks integrates data engineering, science and analytics into one environment. Considered a platform built by and for data scientists, Databricks is one of the leading platforms for AI and has seen tremendous growth (and interest from partners) as a result.

Databricks is in a head-to-head battle for data supremacy with Snowflake, and pushes its partners to choose between the two (even if many customers have both in their environment). Databricks has a large partner ecosystem that it is starting to put more structure around. However, its partner coselling motion remains a work in progress. Databricks has been a natural adjacent partnership for many Microsoft partners, although competition is starting to heat up there as well.

Level of services intensity: Medium

Maturity of partner ecosystem: Growth

Fluent Commerce is a cloud-native distributed order management platform that helps retailers and brands optimize inventory, orders and fulfillment across multiple channels. Its solution enables businesses to deliver a seamless omnichannel shopping experience, improving customer satisfaction and operational efficiency.

Fluent offers a compelling alternative to traditional, complex ERP-like implementations like Manhattan. While still relatively small, the company’s early focus on composability aligns well with current retail market trends. Fluent expanded its partner ecosystem by 20% in the past year and has attracted an impressive number of GSIs as top partners.

Level of services intensity: High

Maturity of partner ecosystem: Growth

OpenAI is a leading artificial intelligence research organization focused on creating and promoting friendly AI for the benefit of all humanity. Known for its advanced models like GPT, OpenAI develops cuttingedge technologies that push the boundaries of machine learning, natural language processing and robotics.

OpenAI and its ChatGPT LLM continues to hold much of the mindshare in the AI space. It’s seeing more pressure in the enterprise from other players like Anthropic, and even its strategic partner Microsoft. However, ChatGPT Enterprise is now being used across hundreds of thousands of use cases. OpenAI’s partner motion remains less focused on service providers than other partnerships, however, its market dominance and new resell program has attracted notable GSIs including PwC, Accenture, and SHI.

Level of services intensity: Unknown

Maturity of partner ecosystem: Emerging

Stripe is a leading financial infrastructure platform that enables businesses of all sizes to accept payments, manage revenue and handle financial transactions online. With a suite of APIs and tools, Stripe simplifies complex financial processes, helping companies scale and manage their online commerce operations globally.

Stripe’s valuation has rebounded nicely in the past year while many of its fintech peers face down rounds, showcasing its market dominance in the financial infrastructure space. We’ve seen the technology grow from a developer tool into a bonafide platform with multiple offerings, resulting in some larger payment transformation engagements. GSI relationships with PWC, Deloitte, Infosys, and others have expanded accordingly. There are a few specialized service partners in the ecosystem, but most see Stripe as an adjacent technology to a CRM, e-commerce platform or ERP. That may change as Stripe continues to move up market.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Growth

Wiz is a cloud security platform that provides realtime visibility and risk assessment across cloud environments. It helps organizations detect, prioritize and mitigate security threats in multi-cloud and hybrid cloud infrastructures, ensuring compliance and data protection.

Wiz’s explosive growth has garnered a lot of market and customer attention over the last few years, with rumors the company is headed toward a possible IPO. Because the solution is easy to implement, there’s less upfront work for partners. The services opportunity comes when the solution identifies vulnerabilities that need remediating. Traditionally, Wiz has focused on partnering with VARs, but it’s looking to add security partners and MSSPs that are ready to expand their security offerings and capitalize on the booming cloud security market.

Level of services intensity: Low to Medium

Maturity of partner ecosystem: Emerging

We’ll reiterate: it’s not easy to pick where to play. But it’s a decision that technology service firms can’t get wrong. We’ll keep doing the legwork to keep this list up to date. But we’d love your help.

Weigh in by telling us which companies and partner ecosystems you think represent the best opportunities in the near term. Share your experience with the software companies you currently represent and what makes their partner programs exceptional, average, or subpar.