Utilization. It might not be the sexiest topic on the planet, but it is probably one of the most impactful metrics within a professional services company. For employees, utilization tends to hold negative connotations, bringing to mind visions of a cog in the wheel. But for services leaders and business owners, it represents financial health.

I’ve worked in professional services for more than 20 years, and utilization has always been a focal point. First, as a consultant who was measured by my own utilization. More recently, as a global delivery leader for companies like Appirio and 7Summits where I looked at utilization as a critical KPI for the company.

Some might say utilization is a necessary evil in the services business. Personally, I think it’s just a little misunderstood. But no matter how you feel about the term, utilization is an important topic for both individual consultants and business owners to understand.

That is the point of this blog: to highlight why delivery leaders care so much about this metric and how businesses can do a better job of managing it so utilization isn’t a dirty word.

What is utilization and why should I care?

In its simplest form, utilization reflects how much billable time an employee generates in a given period, based on the total time available. People have different philosophies on what “total time available” means inside a firm, but for most it’s based on a year comprising 2080 hours. Using that 2080 number as a baseline, some firms will remove holidays, PTO, and development time.

The reason why utilization is so important is quite simple: services firms make money based on selling (and delivering) people’s time so there is a direct connection between utilization and revenue.

The reason why utilization is so important is quite simple: services firms make money based on selling (and delivering) people’s time so there is a direct connection between utilization and revenue.

Let me give you an example: If you have a 200 person delivery team and you raise utilization by one single point, at a $200/hour bill rate, that translates to an $800,000 annual impact to the bottom line. If you raise by five points, the impact is more than $4 million annually.

However, utilization also has a direct correlation to employee satisfaction and burnout. Which is why you need to get this metric right.

How do I set the right utilization targets?

Like most things in services, setting the right utilization target is both art and science. However, getting that target right – where it can be held up as a positive for both employees and employers – is one of the most important things a services leader can do.

Industry benchmarks for most project-based services firms put “best in class” utilization at between 75-85%, however there are a number of considerations to take into account when setting targets. Including:

The profile and makeup of projects or programs. If a company is selling smaller projects at higher volumes, staff will likely be working on multiple engagements at the same time. In this case, utilization may need to be adjusted down to reflect the headspace required for context switching. If it’s larger ongoing engagements, it’s reasonable to expect utilization to be higher.

The way services are sold. In an environment where people are fully dedicated to a project, such as staff aug or through dedicated project teams, those individuals have the ability to achieve consistently higher utilization levels. However, if staff is fractionalized across multiple engagements (where hours may ebb and flow weekly, from project to project), it may be more challenging to achieve goals.

The company or practice’s pace of growth. If a company is growing fast and furious, they may need to hire ahead of plan in order to sell an engagement. In highly competitive environments, where another similar partner is right around the corner, telling a customer they have to wait 4 months to start may not fly. In this case, firms may need to account for some bench time as projects come to fruition, which will lower utilization.

The skills needed and the labor environment. If companies are having a difficult time finding the necessary skills, or are building capacity in a new area that requires significant training, just-in-time staffing likely won’t work. Firms will need to schedule in time for onboarding new employees and training or cross-training before a person can be fully “utilized”.

Analyzing the profile, makeup, and resource allocation models across deals will help a company determine the right utilization targets for them. Along with this, determining organizational models to deliver the services, and having a variety of approaches in place for how teams are structured may assist in hitting higher goals.

How do rates and margins factor into the equation?

While utilization is a measure of employee efficiency, utilization alone will not drive profitability. The cost of labor, bill rates, and deal margins are equally important. You could have an employee utilized at 100% and still lose money if that employee is expensive, and rates are too low.

This is where sales and delivery need to work together. When solutioning a new opportunity, having the right estimating tools and models can allow sales and delivery to see the direct cost of labor by role, apply that to rates, and determine overall margin for the opportunity.

From there, a services company can set deal margin thresholds, and make decisions based on these data points. Identifying a healthy margin and holding to that during sales cycles will help improve profitability.

How do I effectively manage utilization?

For many employees, utilization targets come off as negative and can create undue stress. Missing targets may create fear, while working toward unattainable targets can create burnout. This is where effective management and communication comes into play.

Once the targets are set, leaders should clearly articulate:

- Why these targets are in place

- How managers will help in the achievement of targets

- What to do when targets aren’t met (or seem unattainable)

Employees will argue they can’t control their utilization achievement because of staffing and client behavior, while management tends to gravitate toward the belief that highly skilled, in-demand employees will naturally be highly utilized. The truth here lies somewhere in the middle.

Employees will argue they can’t control their utilization achievement because of staffing and client behavior, while management tends to gravitate toward the belief that highly skilled, in-demand employees will naturally be highly utilized. The truth here lies somewhere in the middle.

Management should be accountable to forecasting demand, ensuring their team is right sized, and supporting performance management. Companies need to provide clarity on what level of bench time is acceptable and sustainable too.

Employees on the other hand should be proactive when the work isn’t there by communicating to their manager, raising their hand, and when all else fails, taking advantage of the time to develop skills or support internal initiatives.

But ultimately, it’s on the company to understand what level of utilization is required, and for managers to ensure they are bringing in the right talent, enabling them, and staying in front of demand.

Utilization is at the heart of a healthy services business

Utilization can be one of those metrics that can hurt or help a company, depending on how you evaluate, set targets, and support the team in their achievement.

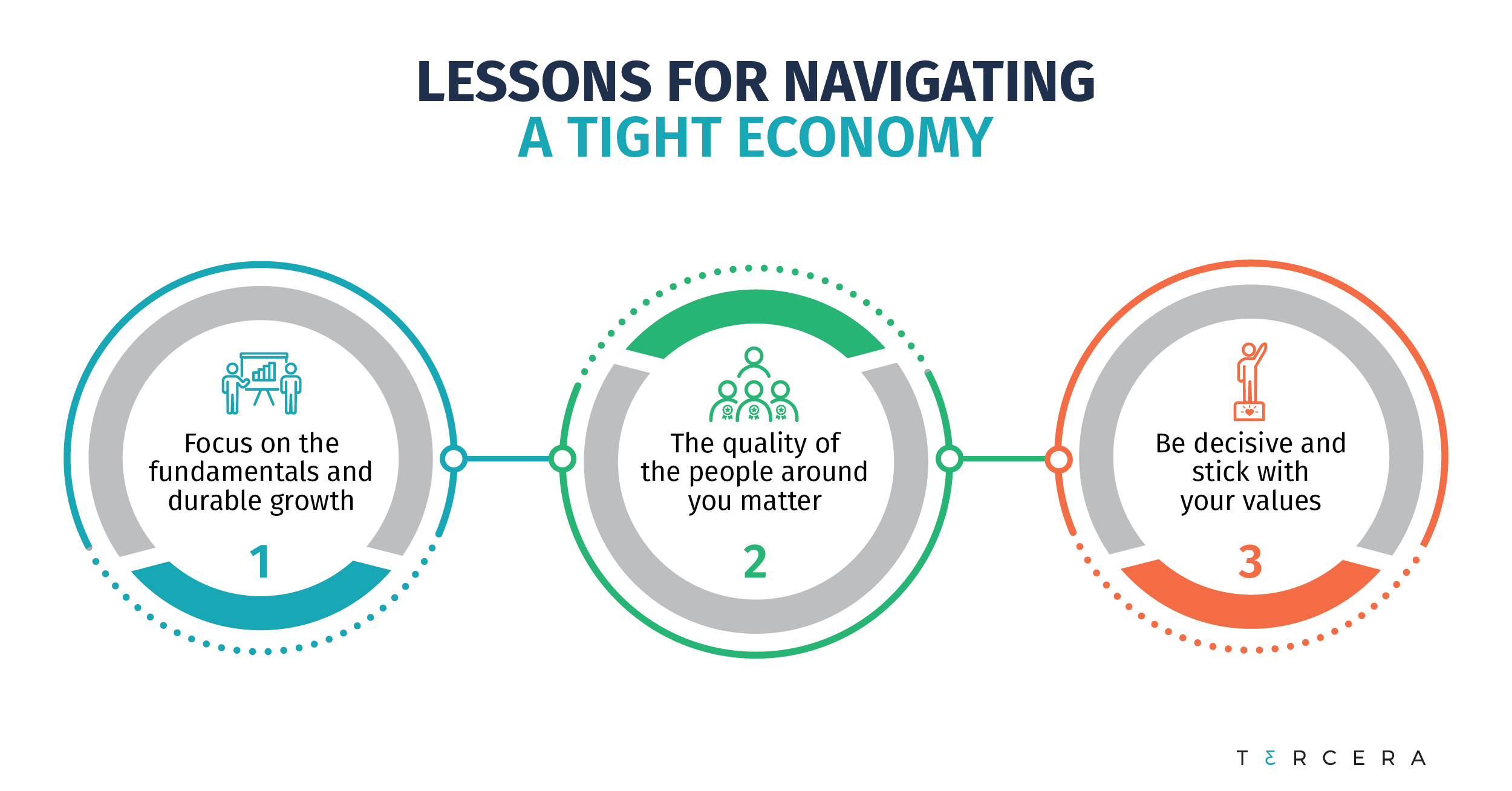

If the goals and targets are too aggressive or unattainable, employees may not feel supported and that’s where attrition will rise. Burnout is real, and employees have options – even in a tight economy. On the flip side, if the targets aren’t right, companies won’t have a healthy, growing business with profits to invest back into the business (and the people).

Evaluate your overall financial plans, look at costs, project profiles, organizational delivery models, rates and margins and then make a decision(s) that will best support the financial health of your organization along with the well being of your team.