In the world of IT services, where innovation is rapid and competition is fierce, one crucial growth lever often gets overlooked: Marketing. Channeling my inner Julia Roberts from Pretty Woman…Big Mistake. Big. Huge.

When done well, marketing can move a firm from invisible to indispensable. From a me-too to a market leader. From a deal chaser to demand shaper.

Product companies (and their investors) intuitively understand this. They know you can have the best product on the planet, but if no one knows it exists or understands why they need it, game over. They recognize that a strategic marketing function can not only drive revenue today, but shape the trajectory of future revenue as well.

Unfortunately, many of the tech services firms we speak with don’t have that same mindset around marketing. In too many cases, marketing is seen as a tactical sales support function versus a strategic growth lever.

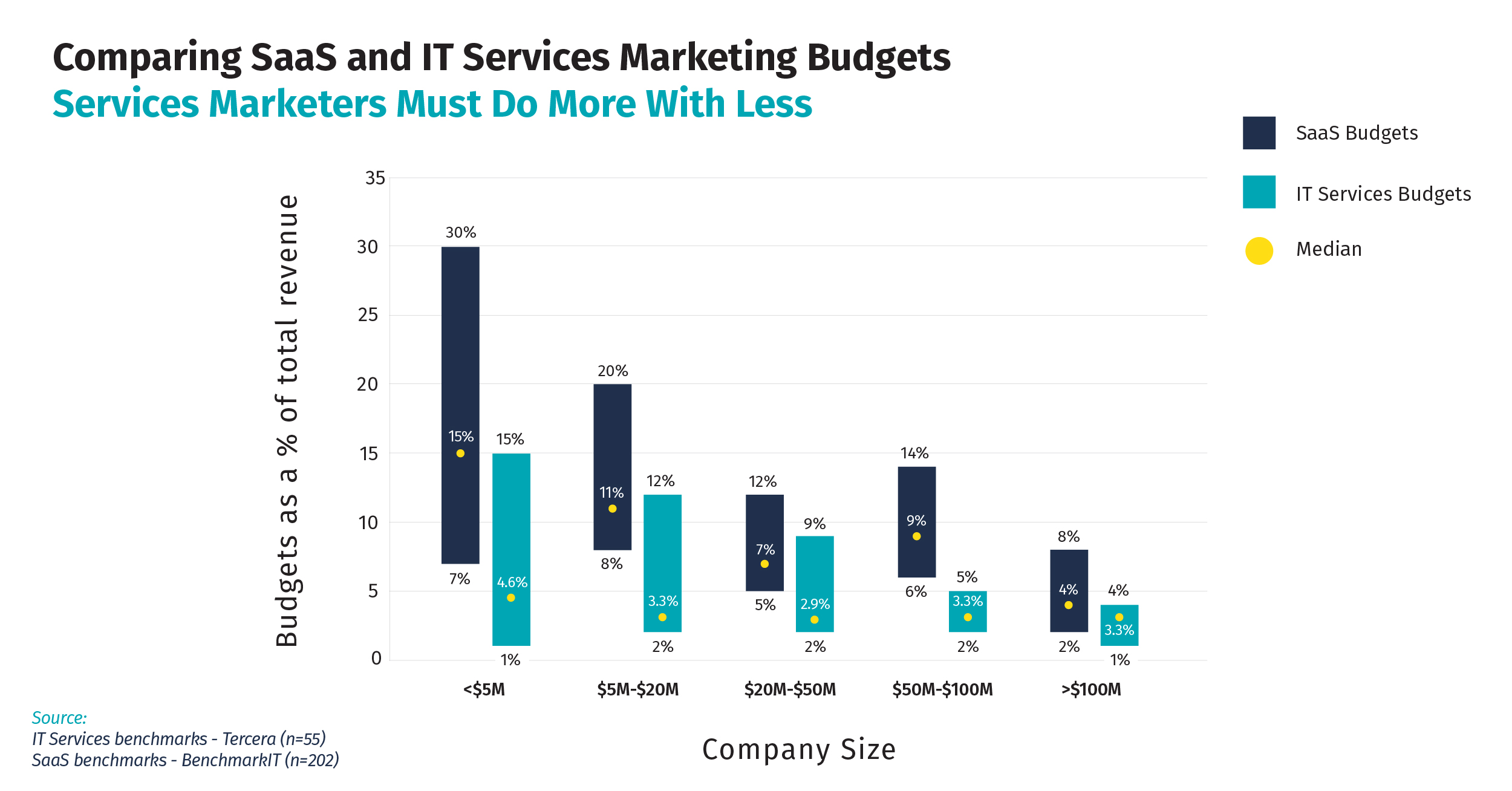

This plays out in the numbers. When you compare marketing budgets as a percentage of overall revenue, services budgets and team sizes are a fraction of what product companies report. This is true across all sizes, but it’s especially pronounced in earlier stages. Below is an interesting comparison using benchmark data from Carilu Dietrich/BenchmarkIT and Tercera.

To keep costs in check, firms will often forego hiring an experienced marketing leader who can put a real growth strategy and structure in place. Someone who understands the discipline of marketing, and the role it can play in not just demand generation, but also brand relevance to company strategy. Instead they hire more sales reps, supported by tacticians who can organize events, maintain a website or churn out blogs. Or worse, they try to outsource everything to AI. That may work for a while, until it doesn’t

Don’t get me wrong. AI is fundamentally reshaping the marketing function, automating and augmenting many marketing tasks. According to a March 2025 McKinsey study, marketing and sales is the business function using AI the most today, with about half of professional services firms using gen AI regularly.

For services marketers that have already learned to operate lean, AI is helping them to work smarter and tap into firm-wide intelligence in ways that haven’t been possible. However, AI is not a magic bullet and it certainly won’t replace marketing. Without the right oversight and guidance, AI can do more harm than good – but that is for another blog.

For services marketers that have already learned to operate lean, AI is helping them to work smarter and tap into firm-wide intelligence in ways that haven’t been possible.

Why Does Services Marketing Lag Behind?

Before considering where and how to give your services marketing a makeover, it’s important to understand why services marketing lags behind and sees less investment than other sectors.

Thin wallets. Professional services typically have much thinner profit margins than product companies. Tighter margins mean smaller budgets. Smaller budgets mean fewer experiments, smaller tech stacks, and often less experienced teams.

Billable hour gravity. Time is literally money in services. Every non-billable hour or headcount gets scrutiny in a people-based business, which is why many firms rely on their consultants to drive thought leadership in the market. But when clients call, marketing takes a back seat.

Trust over fluff. High-stakes, career defining projects hinge on reputation, referrals and limiting risk. This is why services marketing depends so heavily on brand, thought leadership and partner relationships. This type of marketing is harder to measure, takes longer to yield results, and requires patience and focus – something leaders are short on these days.

Long, complex sales cycles. Large services deals almost always involve multiple stakeholders. These deals can take 12-18 months to close, and require dozens of interactions to build trust in an outcome that can’t be easily ‘tried on’. This makes ROI hazy and hard to track back to a specific source. Without clear attribution, CFOs hesitate to double-down.

You can’t ‘try it on. Services are intangible and variable. Buyers can’t touch or demo a service the way you can a product, and every project/program is at least partly bespoke in services. Product teams iterate on a single SKU; service teams must juggle dozens of use-case narratives.

Given these factors, it’s understandable why tech services leaders look to other avenues for growth, or why they throw up their hands when the leads don’t come pouring in. But as a CMO and investor, I can assure you that if you invest wisely, it pays dividends.

What Does Great Services Marketing Look Like?

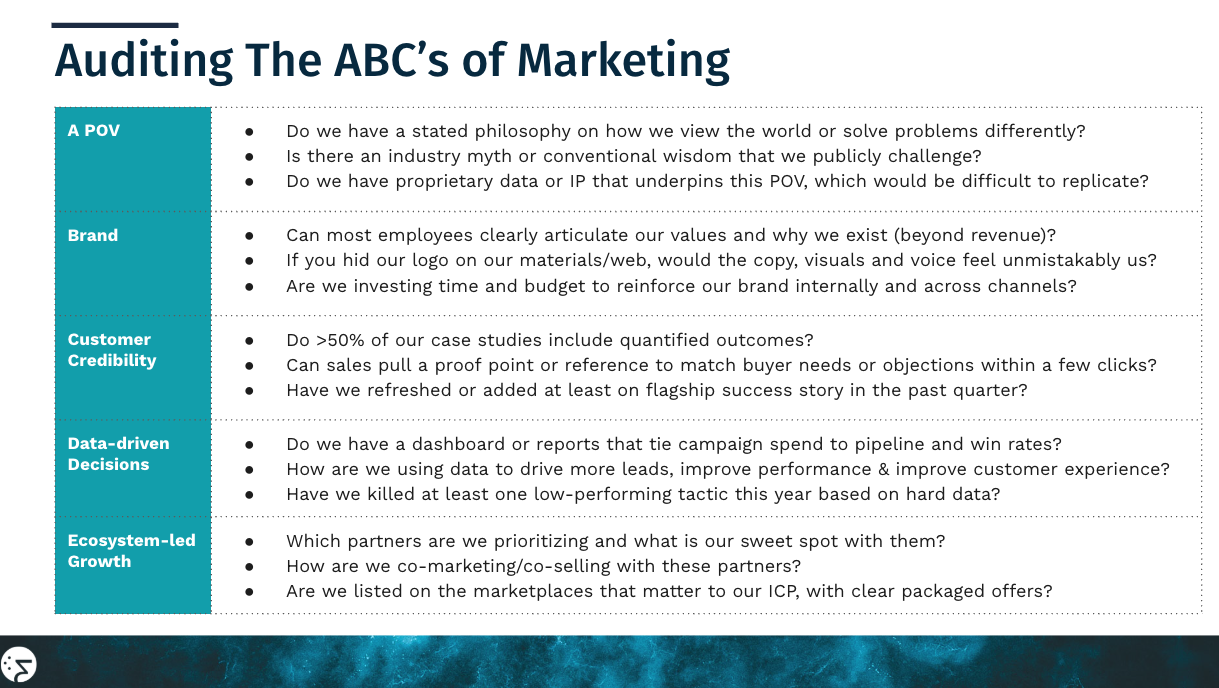

Great services marketing comes in all shapes and sizes, and playbooks are evolving every day in this AI era. But there are some standard elements that differentiate great marketing from just good marketing. I call these the ABCs of great marketing.

- A strong point-of-view

- Brand that stands out

- Customer credibility

- Data driven decision making

- Ecosystem-led growth

A Point of View: Crafting a standout POV is hard by design. It starts with a forensic grasp of your ideal buyers. What are their mental models? What are they hearing elsewhere, and what is the white space only your “secret sauce” can fill? Understanding this requires solid alignment with sales and delivery, plus the nerve to plant a flag that may repel as well as attract. When you sound agreeable to everyone, you’re not saying anything that matters.

Brand that stands out. Your brand is a proxy for competence and character. It’s emotional shorthand for how you show up to buyers and employees, exhibited consistently in your words, design and actions. It’s not a tag line. This is about knowing who you are, what makes you unique and putting that out in the world regularly and consistently.

Customer credibility. The best way to market your expertise and the value you can deliver is through customer stories. These stories are your most credible, versatile and persuasive currency, able to transform the intangible into the concrete, and offer proof that your prospects (and their buying committees) need to make the leap of faith.

Data-driven decision making. Data is the glue that helps marketers navigate the noise and make sense of an increasingly complex buyer’s journey. This includes using intent data to identify prospects, or tracking engagement and CSAT data to engage at the right level and time, or monitoring which campaigns and tactics are delivering real pipeline and bookings. Marketing today is as much science as it is art.

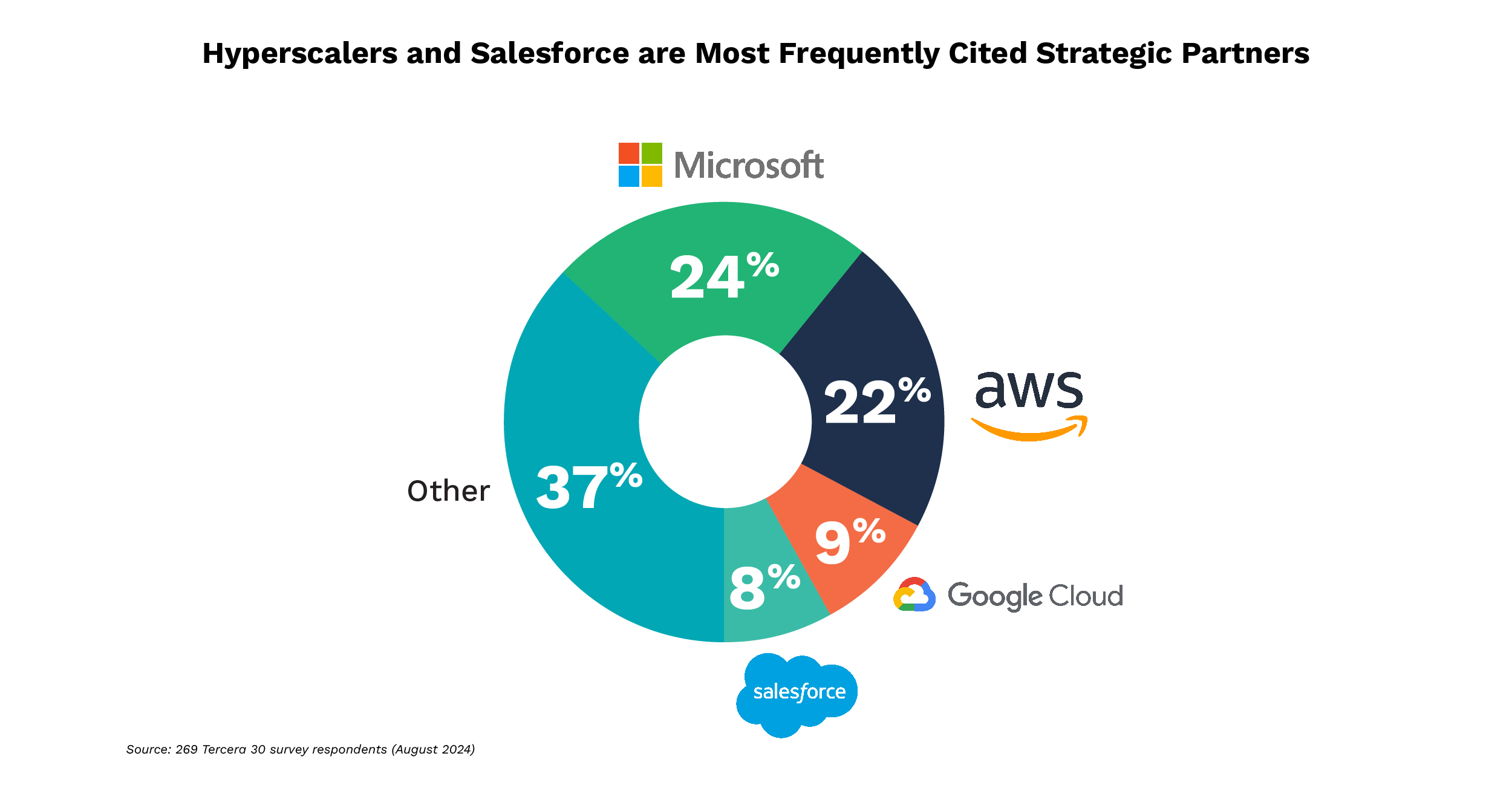

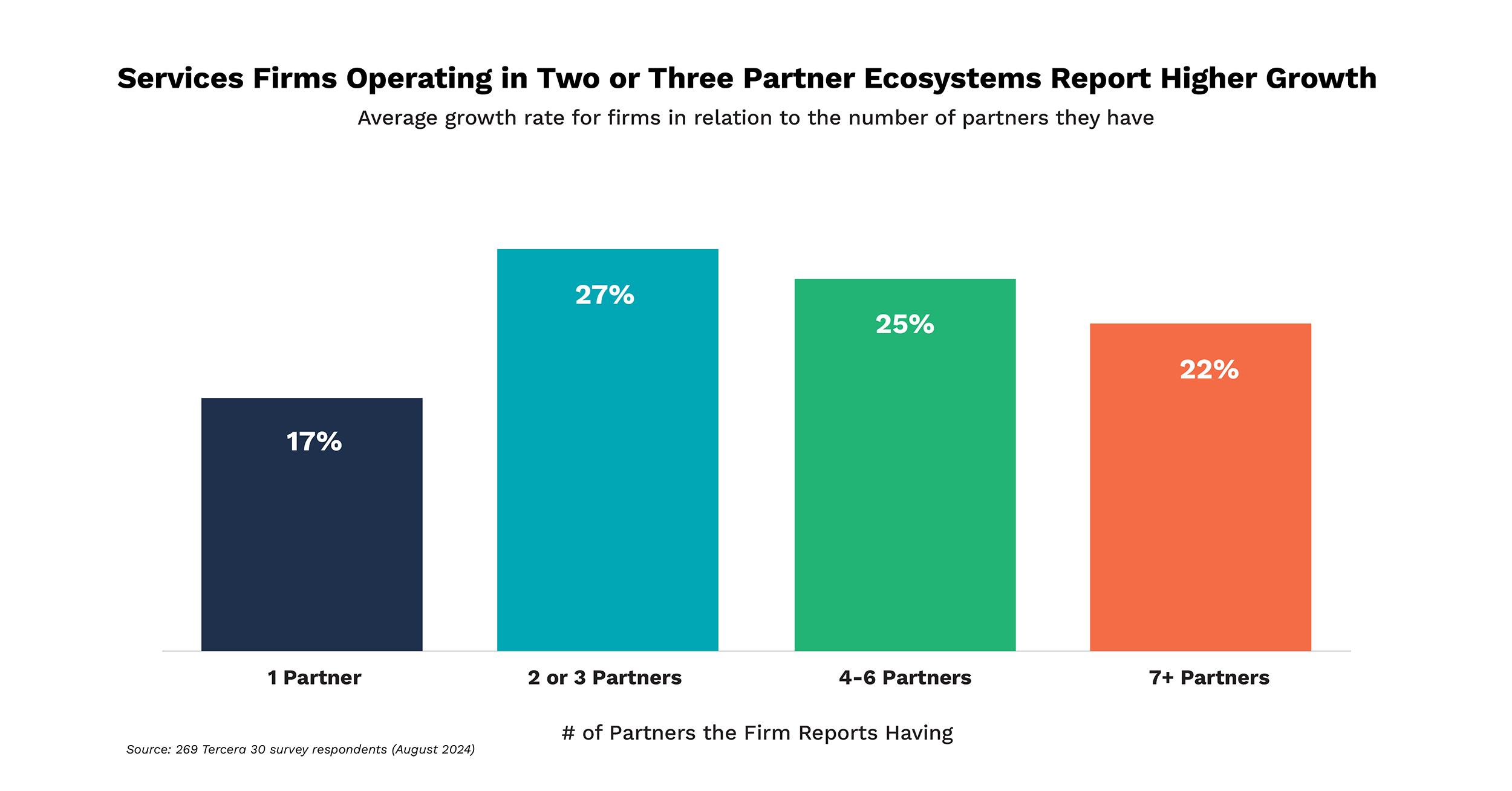

Ecosystem-led growth. Tapping into partnerships and ecosystems can be the quickest path to relevance and growth for services firms. Firms that build strong go-to-market partnerships with the right software firms can lower acquisition costs, improve win rates and speed sales cycles. Cloud and vertical marketplaces are also opening up opportunities, enabling firms to list packaged offerings, connectors or fixed scope bundles to a broader audience.

How To Know if Your Marketing is Up to Par?

To understand how your own marketing stacks up in the areas above, here are a few questions you can ask yourself or your team to spot the weak links:

If you don’t like the answers to these questions, pull together leaders from across sales, marketing and delivery to brainstorm ways to improve here. If you don’t have a strong marketing voice at the table, there are ways to bring that in through advisors, fractional CMOs, consultants.

Also, take a look at your marketing budget. How do you stack up against those benchmarks mentioned above? Evaluate where your marketing dollars are going and whether they are yielding results, or could be spent in other areas? Before you crank out another white paper or sign up for the same event you did last year because that’s just what you do, hit pause and ask if that’s serving you.

Above all, remember that marketing is a complex but essential function. Not just for today’s revenue but for future revenue. Marketing can help create a moat around your business that can make it hard for competitors to encroach, keep you relevant in shifting markets, and allow you to command higher prices over time.

Marketing can help create a moat around your business that can make it hard for competitors to encroach, keep you relevant in shifting markets, and allow you to command higher prices over time.

If you aren’t investing in it and your competitors are…that could be a big mistake. Big. Huge.