Tercera Looks to Accelerate Technology Professional Services Businesses Specializing in the Third Wave of Cloud Computing

EVERYWHERE – Jan. 28, 2021 – Tercera, a new growth-focused investment and advisory firm specializing in technology professional services, launched today to accelerate consultancies and managed service providers in the $460 billion cloud services space. Tercera will put $225 million in equity capital to work building the next generation of cloud leaders, focusing on services firms that specialize in analytics, automation, data, security, enablement and management of cloud technology.

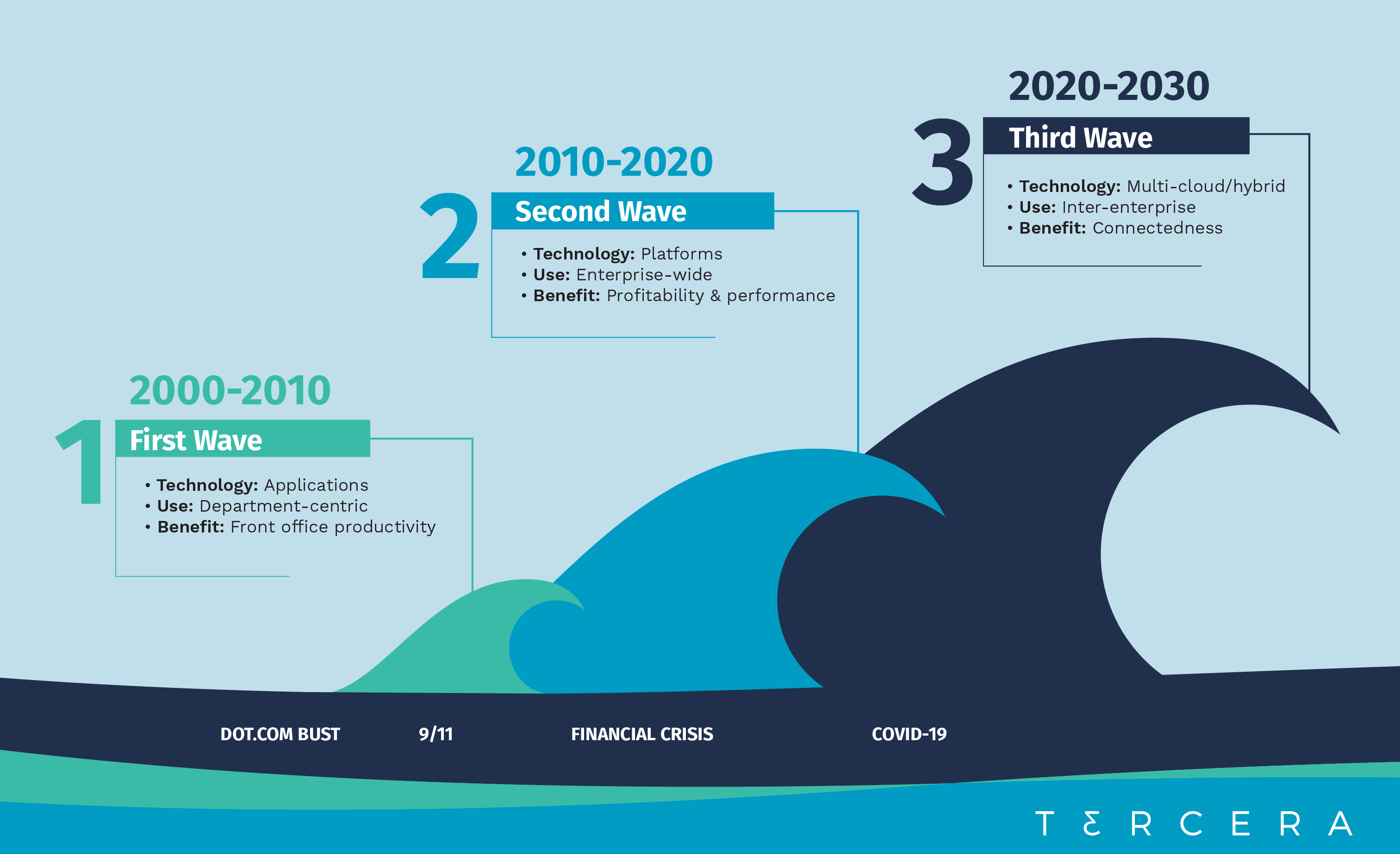

The company, which is led by a team of seasoned investors and advisors who are deeply ingrained in professional services, is on a mission to empower the people and businesses who make technology work. Spanish for Third, Tercera provides those leading the cloud’s Third Wave with the capital, counsel and connections they need to scale faster, do more and achieve outsized outcomes in today’s digital age.

CEO Chris Barbin founded Tercera based on his experiences as the co-founder and CEO of Appirio and his recent work as a Venture Partner at GGV Capital. Appirio, a pioneer in cloud services, was among the first enterprise services partners of Salesforce, Google, Workday and AWS. Barbin led Appirio to be one of the largest cloud consultancies before it was acquired in 2016 for $500 million. The Tercera team is seeking to help other services companies achieve similar success in a market segment that has been historically neglected by other investment firms.

“We believe the professional services space has been underserved by investors for too long, especially as it becomes clear just how important these partners are to customer adoption and market growth,” said Chris Barbin, founder and CEO of Tercera. “Cloud professional services is already a massive market opportunity, growing more than 20 percent year over year. With the pandemic driving more digital connections with customers, partners and employees, and enterprise cloud adoption happening faster than expected, we believe this market is poised for significant growth over the next few years.”

“Businesses rely on cloud computing like never before and it underpins so much of the innovation happening in technology, so it’s not surprising cloud professional services are booming on G2,” said Godard Abel, founder & CEO of G2, the world’s largest B2B tech marketplace. “Businesses are in dire need of systems integrators and managed service providers who can help them manage their increasingly large and complex cloud deployments, and yet the capital flowing into this space has significantly lagged investment in the technologies themselves. Tercera fills a gaping hole in this area, and we’ll be closely watching the firm’s portfolio in the coming years.”

Trilantic North America, a private equity firm that manages aggregate capital commitments of $9.7 billion, partnered with Chris to form Tercera, joined by a network of individual investors aligned with Tercera’s people-first vision. Tercera looks to partner with services firms that are founder-led, growth-focused and cloud-driven.

Tercera typically takes a minority stake in companies, investing between $5 million to $20 million of capital, selectively partnering with other firms and strategic investors as businesses scale. However, the company will provide more than just growth capital. It is also building out a services-oriented Advisor Network that will provide practical and diverse guidance and support to founders.

“Capital is only one component to growth,” continued Barbin. “Experienced guidance and a support network play an equal role in helping founders and teams scale faster and more gracefully than they could on their own. The Tercera Advisors are services professionals who have built, bought and sold services organizations, or run critical functions in services businesses. They bring the pattern recognition, diversity and playbooks that growth companies need.”

Useful Resources

Definition and players in the cloud’s Third Wave

Read Tercera’s people-first manifesto

Connect with Tercera on LinkedIn

Follow Tercera on Twitter at @TerceraCapital

Follow Tercera’s blog for news, trends and advice in cloud services

About Tercera

Tercera is an investment and advisory firm founded to accelerate the growth of people-centric businesses. Specializing in the $460 billion cloud professional services market, the Tercera team is composed of invested operators who know first-hand what it takes to build and scale a successful cloud services business. Tercera (Spanish for ‘third’) is on a mission to identify the people and partners who will lead the next wave of cloud computing – the Third Wave – and provide them with the capital, counsel and connections they need to scale faster and take an outsized share of the market. For more information, visit: https://www.tercera.io/.