Last week the valuation of professional services firms reached a high water mark when Hitachi announced plans to acquire digital engineering services company, GlobalLogic, for $9.6 billion, or 8x revenue! While this is the largest IT services acquisition year to date, it’s certainly not going to be the last.

GlobalLogic’s 20,000 professionals in 14 countries will be integrated into Hitachi’s Lumada IoT business, and is part of the company’s ongoing evolution from hardware to digital services.

While the 8x revenue multiple Hitachi paid for GlobalLogic is a high water mark for an IT Services M&A transaction, the multiple is in line with valuations for publicly traded high growth digital engineering services firms like EPAM, Globant and Endava. These firms are currently trading for 7.7x, 10.1x and 13.2x revenue, respectively.

These valuations, along with the volume of acquisitions, signal a market shift which entrepreneurs, acquirers and investors should take note.

For decades, investors have viewed professional services firms as less attractive and riskier than software companies. Whereas product company valuations might range from 20-100x forward-looking revenue, services firms saw historic valuations more in line with 0.5x to 1.5x revenue. While multiples have been creeping up over the last decade for services firms — especially cloud consultancies that specialize in disruptive technology — we’re starting to see 2x to 4x valuations become the rule rather than the exception. Services firms are finally getting the cred they deserve!

Why is this shift happening?

The most simple answer is that companies of every size are reshaping their business for a digital world. I won’t bore you with the stats because you’ve already heard them. But I will say digital transformation is now a board-level conversation, not just a talking point among IT leaders, and companies need help navigating this next wave of innovation.

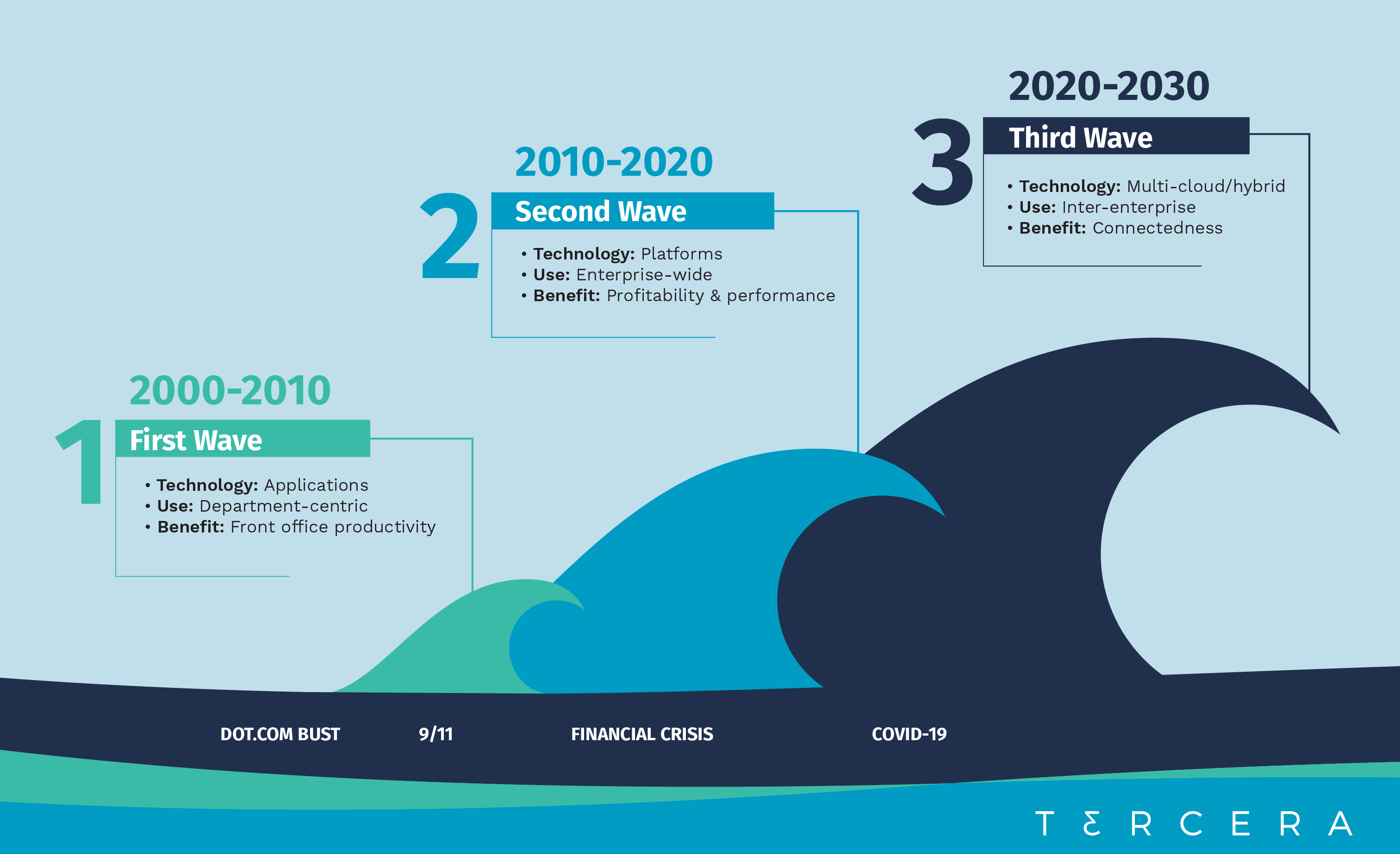

No one understands this more than the global systems integrators (GSIs), which are seeing their traditional services businesses decline, while competing more with these digital engineering firms. They’re looking for growth and capabilities in new areas, and most of that growth is happening in the cloud’s third wave.

Cloud computing is now mainstream. For 20 years it’s been upending the way companies operate and build, and enterprises are now using public, private and hybrid clouds as a backbone for their digital transformation. In the cloud’s third wave companies are building their own customer-centric, data-intensive, digital experiences from the ground up, not just relying on a small handful of vendors. Those experiences cross organizational boundaries, and require orchestration between hundreds of different cloud building blocks. This is why third wave cloud consultancies and digital engineering firms are so attractive.

In the cloud’s third wave companies are building their own customer-centric, data-intensive, digital experiences from the ground up, not just relying on a small handful of vendors.

Unlike GSIs, which are built around large (often legacy) platforms, these next gen firms are not tethered to a specific platform. They have capabilities across them, and are more focused on custom development rather than platform configuration. According to Gartner research, the 13 largest GSIs hold only 30% of the market for custom software development with the remaining 70% of the market held by more than 10,000 local, regional and midsize players.

This is why companies like IBM are being so acquisitive. By bringing on firms like Nordcloud, a European cloud integrator with 500 consultants certified in Amazon Web Services, Microsoft Azure and Google Cloud Platform, IBM isn’t just specializing in its own stack of technologies. It’s working across them, supporting customers no matter what their digital strategy may be.

The digital era requires new skills, new models

Third wave cloud consultancies and digital engineering firms also bring something that GSIs, customers and vendors need desperately — specialized skills in areas like IoT, APIs, cloud integration, data science, cybersecurity, DevOps, e-commerce, new programming languages, etc.

The war for talent is real, and based on our conversations with hundreds of services firms and the cloud vendors, it’s getting worse. Talent acquisition and retention is a core competency for services firms, and the firms that are adapting their talent capabilities to this new world are those that will thrive.

Workforce models are evolving quickly. Next generation services firms have been optimizing for distributed and remote workforces for the last few years, not just as a response to Covid. It’s been a competitive differentiator, giving them access to specialized talent no matter where people live. These firms have also been learning how to use on-demand “gig” talent in new ways, which requires different internal processes. These aren’t overnight changes.

Delivery and pricing models are evolving as well. Next generation firms (like more and more customers) are less focused on big-bang transformations and project work. It’s more about providing capacity and skills for ongoing programs that add value in an iterative way over time – and pricing it accordingly. Services firms that make it easy for customers to get started quickly, scale up and down as needed, offer free ‘demo services’ up front, and that offer packaged IP to speed time to value will have a leg up on the competition.

The GSIs are well aware of these trends. But they’re big. They have entrenched relationships with legacy vendors and cash cow businesses that, while declining, still need support. For them it’s better to be a fast follower than a first mover, and to let the boutique services firms incubate these capabilities and then use their large stockpiles of cash to acquire them.

That’s not a new model, but there’s a lot of cash in the market and stakes are getting higher. This is going to be an interesting few years for services!