Ten years ago, Marc Andreessen predicted software would eat the world.

He was half right. People — not just code — will play a defining role in the cloud’s third wave.

At Tercera, that’s why we started an investment and advisory firm 100% focused on supporting people-based services businesses.

It’s clear to us that businesses using software and the businesses creating software (which is now every business) will need skilled humans to design, develop, deploy, manage, integrate, test, use, evolve, market and sell that technology.

But while that’s an incredible opportunity, it’s also a challenge.

People keep getting harder to find and retain. Korn Ferry predicts a global shortage of 85 million tech workers by 2030, which could cost businesses $8.5 trillion in unrecognized revenue. That people shortage is at the center of nearly every prediction we’re about to make.

How Tercera’s predictions work

Since it’s not that hard to predict broad trends, we’re going a step further and making a set of very specific predictions about what will actually happen. Yes, this boosts the odds of getting some things hilariously wrong, but it also made us think harder about the future — and that’s always a good thing.

So without further ado, the top 10 things we see shaping the world of IT professional services over the coming year.

Prediction 1: Talent becomes the biggest barrier to growth for tech companies.

The Great Resignation (or put more accurately, the Great Reshuffle), combined with a growing demand for digital skills and an influx of capital into services (more on that later), means businesses will face a fierce fight for the talent they need to hit growth targets.

- Attrition rates will more than double what they were pre-pandemic.

- Companies will substantially increase their use of AI and automation to make existing employees more productive or, in some cases, redundant.

- CEOs will shift more of their time to recruiting and away from customer-facing sales, which may have broader consequences to growth numbers.

- Chief People Officers who can successfully navigate this chaos will finally get the raises, and accolades, they deserve.

Prediction 2: Despite best efforts, diversity progress slows amidst the fight for talent.

Intense pressure for people-based services firms to find talent in such a competitive space means diversity goals may take a back seat to hiring and revenue targets.

- The percentage of minority and under-represented groups within IT service firms won’t significantly improve in 2022.

- Board diversity will fare better due to instituted requirements from investment banks, stock exchanges and the public sector.

- DEI initiatives will shift from traditional recruiting channels to training programs for non-tech candidates or retraining mid-career individuals returning from caretaking or military careers.

- The firms who can keep their foot on the DEI pedal will be rewarded with higher degrees of engagement and performance.

Prediction 3: Services investments pick up in private and public markets.

The skyrocketing valuations of product companies, combined with the growing focus on labor, means more capital than ever before will flow into IT services. This will drive up interest in earlier stage investments, valuations and M&A activity within the space.

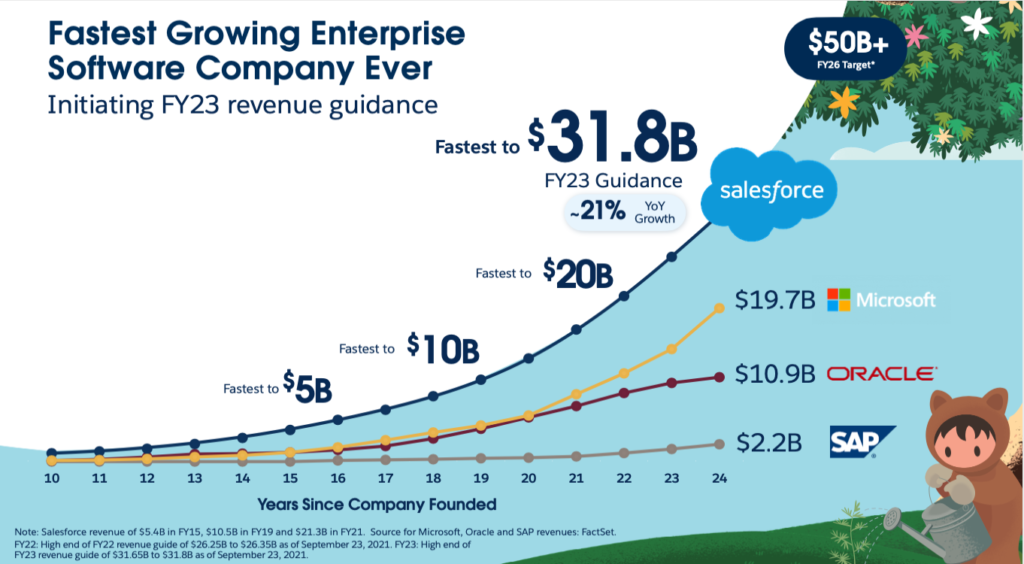

- Cloud vendors will use their venture arms to invest capital into more services partners (not just product companies), replicating Salesforce’s gold standard channel playbook.

- The GSIs will maintain spending levels to acquire high growth IT services firms. However, more financial sponsors (PE, VC and growth equity firms) will get into the game, increasing the volume of M&A.

- There will be far more public IT services firms in the next 2 years than there are today.

Prediction 4: Gross margins take a hit.

The inflation we’re experiencing is not going away anytime soon — the Fed has admitted “transitory” might have been too hopeful. This combined with talent scarcity is going to drive up costs. Beyond increasing wages, firms will also need to invest more in recruiting, sales and marketing to build their brand and compete for talent – all of which will have a negative impact on gross margins.

- The majority of services firms will raise bill rates to compensate for inflation and increased costs, which will temporarily compress margins. The most forward-looking firms have already started the process.

- Founders will look to raise capital earlier than in the past to smooth cash flow challenges and support growth.

- This is not the only year that employees are going to come knocking for a 5-10% wage increase. Or more.

Prediction 5: Managed identity and security services continue their run.

Companies must protect an increasing amount of data spread across multiple cloud and on-premise systems, while providing greater data access to remote employees, partners and suppliers. But hiring qualified security talent won’t be easy. As a result, businesses will increase their reliance on managed security service providers (MSSPs), and what they expect of them. (Disclosure: Managed identity service provider BeyondID is a Tercera portfolio company)

- There will be at least one military-grade security incident with a major cloud provider that will drive attention and growth for cloud-focused MSPs.

- Cyber insurance providers will continue to increase rates and compliance requirements. This will drive up costs for cloud vendors and service providers, but will also increase demand for cybersecurity solutions and services, like multi-factor authentication.

- More MSSPs will go beyond monitoring and begin offering managed detection and response (MDR) services.

Prediction 6: Large companies lose talent to freelance markets.

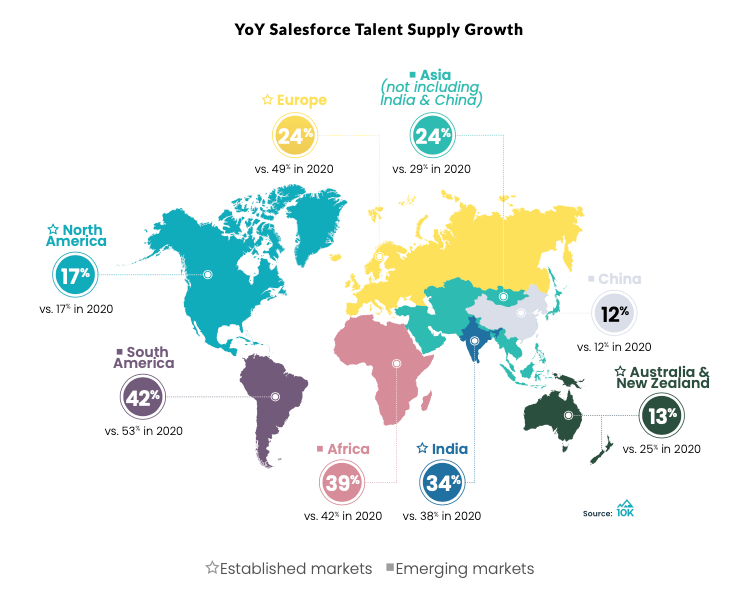

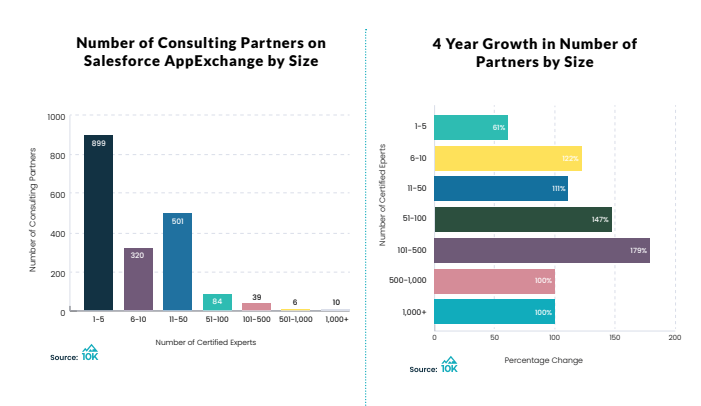

The global pandemic shifted tech workers’ priorities, with many starting their own businesses or freelancing. That trend will continue well into 2022, as freelance platforms like Upwork, CloudDevs and 10K make it easier to match global talent with a growing number of customers who are hurting for talent.

- Big name consultancies will have a harder time recruiting entry-level employees out of college as the more entrepreneurial Gen Z chooses flexibility over stability.

- A higher percentage of customers and service providers will partner with on-demand talent platforms to supplement internal resources.

- One large cloud ISV will build out or acquire its own independent talent marketplace to access the growing amount of freelance talent globally, and to have greater control over the customer experience.

Prediction 7: Cloud services continue their verticalization.

Enterprise cloud ISVs will continue to double down on their vertical go-to-market strategies, dragging partners along with them. Verticalization isn’t new, but Industry Clouds have become a bigger growth engine for cloud providers. Those providers will invest in the partners who can add value through accelerators, integrated products, common data and ML models, and of course, customer references.

- We’ll see a dramatic rise in the number of cloud consultancies opting out of the horizontal game and specializing in 1-2 verticals. Focus = growth.

- Healthcare and manufacturing will receive a lot more attention from ISVs and partners next year, especially given projected cloud growth and customer demand.

- The GSIs and public digital engineering firms shift acquisition focus to tech consultancies and agencies focused on a specific vertical, rather than a specific platform. EPAM’s recent acquisition of Optiva Media is a great example.

Prediction 8: Services firms embrace the new digital workstyle.

Many services firms had work-from-home policies long before COVID hit and have more progressive views on remote work than many tech firms. As the Omicron variant forces businesses to rethink a return to the office, firms will get creative in crafting connected employee experiences for those who do and don’t want to come into an office.

- Companies with large real estate holdings will repurpose offices into co-innovation spaces, opening them up to customers, partners and the startups they’re incubating.

- More services firms embrace the ‘metaverse’, from firms like Accenture that are using virtual reality to help with collaboration and new hire onboarding, to firms like Globant that are creating practices in this new area.

- We tire of staring at Zoom screens for 8 hours, and re-embrace the phone call as part of our new “digital workstyle”.

Prediction 9: LATAM stays red hot.

Investment activity in Latin America has exploded in the last couple of years, and shows no sign of slowing in 2022. The region is now home to a stable of 26 unicorns and has the second fastest growing IT specialist population, second only to Asia Pacific. That makes it an attractive destination for tech services companies hungry for talent, diversity and access to new markets.

- A growing number of services firms will look to expand into Latin America to build out nearshore delivery centers, taking advantage of the proximity, lower cost labor and access to an increasing number of STEM graduates.

- As LATAM interest picks up and more capital enters the region, the competition for tech talent in the major hubs will begin to increase wages (although not to the extent of other markets).

Prediction 10: A single Bitcoin will be worth $69,832 on Dec 31, 2022.

This will … most likely be wrong. But we asked 50+ smart people what they believe a single Bitcoin will be worth on the last day of the year, and their answers ranged from $150,000 to $5,000 to 367,508 Dogecoin. We went with the average so let’s see how the wisdom of crowds works! Any predictions on how many services firms might take Bitcoin for payment in 2022?

Expect more detail on a few of these predictions in the coming months!